80% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you can afford to take the high risk of losing your money.

Plus500 is a global CFD trading platform trusted by over 24 million users worldwide. It is FCA-regulated in the UK, offering access to forex, stocks, indices, commodities, and crypto CFDs through an intuitive, low-fee platform.

Designed for confident traders, Plus500 focuses on advanced trading tools, leverage options, and efficient mobile execution.

This review evaluates Plus500 using a qualitative points-based scoring system, analysing its fees, spreads, regulation, usability, and support. Each category is weighted and converted into a star rating, helping you decide whether Plus500 is the right trading platform for your goals.

For more information on how we test view here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

How does Plus500 perform overall?

Overall rating: ★★★★☆ (4.6 / 5)

Plus500 scores an impressive 4.6 out of 5 stars, based on an average performance score of 86.2% and a total of 77.6 points. It stands out as a reliable and user-friendly CFD trading platform suited to both experienced traders and confident beginners.

However, Plus500 is not a share dealing platform, meaning you can’t buy or own real stocks or ETFs. It’s best suited for users focused on speculative CFD trading rather than long-term investing.

The platform’s low fees, smooth onboarding, and intuitive interface make it accessible, while advanced features like +Insights, the Economic Calendar, and the Trading Academy add valuable trading support.

Beginners should start with the free demo trading account and explore the educational materials before using real funds, as CFD trading involves high risk due to leverage.

Here’s how Plus500 performed across each review category:

| Category | Points | Star rating |

|---|---|---|

| Fees | 8.9 | ★★★★☆ (4.5) |

| Safety | 9.6 | ★★★★★ (5.0) |

| Onboarding | 9.5 | ★★★★★ (5.0) |

| Deposit & withdrawal methods | 9.5 | ★★★★★ (5.0) |

| Markets | 6.3 | ★★★☆☆ (3.0) |

| Tools | 8.5 | ★★★★☆ (4.5) |

| Trading platform | 8.8 | ★★★★☆ (4.5) |

| Education | 8.8 | ★★★★☆ (4.5) |

| Customer service | 9.5 | ★★★★★ (5.0) |

Verdict: Plus500 is excellent for CFD trading only. If you want to trade real shares, ETFs, or build a long-term portfolio, this platform won’t meet your needs.

Pros:

- Reliable, FCA-regulated broker

- User-friendly and intuitive platform

- Low fees and fast onboarding

Cons:

- Limited educational content depth

- CFDs only, no share dealing

What are Plus500’s fees?

Overall rating: ★★★★☆ (4.5 / 5)

Plus500 offers a transparent and straightforward fee structure, with no hidden charges on deposits or withdrawals. Most costs align with industry standards, though CFD and forex spreads can be higher than some competitors.

Deposits

Plus500 does not charge any deposit fees, so you can trade with your full balance. The minimum deposit is £100, which may be a little high for casual investors.

For comparison, eToro’s minimum deposit is £75.30 for UK users and also comes with no deposit fee. If you prefer a lower entry point, eToro may be the better option.

Withdrawals

Withdrawals are free of charge, meaning your profits aren’t reduced by extra costs. This is a strong advantage for active traders.

However, remember that while you save on fees, trading CFDs carries high risk, and losses can outweigh these savings.

Like Plus500, eToro also offers free withdrawals for UK users, although U.S. accounts are charged a $5 fee.

CFD and forex fees

Plus500 charges no commission on CFD or forex trades. Instead, you’ll pay only the spread fee, the difference between the buy and sell price.

While this structure is simple, spreads can add up over time, particularly for frequent traders. Forex trading costs are generally in line with industry averages.

Currency conversion and inactivity fees

A 0.7% currency conversion fee applies when trading in currencies other than your account’s base currency. This is standard among CFD brokers.

An inactivity fee of £10 per month is charged if you don’t log in for three months, though this can easily be avoided by logging in regularly.

By comparison, eToro’s inactivity fee is lower (around £7.44) and only applies after 10 months of inactivity.

Professional client benefits

Professional clients can access cash rebates and higher leverage, but most retail traders won’t qualify for these benefits under FCA rules.

Pros:

- No deposit or withdrawal fees

- Industry-standard forex and CFD costs

- Higher leverage for professional accounts

Cons:

- CFD spreads could be lower

- £100 minimum deposit

- £10 monthly inactivity fee

Is Plus500 safe and regulated in the UK?

Overall rating: ★★★★★ (5 / 5)

Yes, Plus500 is one of the safest CFD trading platforms in the UK. It is authorised and regulated by the Financial Conduct Authority (FCA) under FRN 509909, ensuring strict compliance with UK financial laws and client fund protections.

Founded in 2008, Plus500 has maintained a strong reputation for transparency and reliability for over 15 years.

Unlike many competitors, Plus500 Ltd is listed on the London Stock Exchange (LSE), meaning its financial data, governance, and company operations are publicly disclosed.

This offers an extra layer of transparency and trust rarely found among CFD brokers.

For comparison, eToro is also FCA-regulated and has operated for over 17 years, giving it a slightly longer track record.

However, eToro is not publicly listed, which gives Plus500 a notable edge in transparency and corporate accountability.

The only minor drawback is that Plus500 does not hold a banking licence, though this is typical among online brokers and not a cause for concern. Client funds remain segregated and protected under FCA rules, and the platform’s public listing adds further oversight.

Pros:

- FCA-regulated (FRN 509909)

- Listed on the London Stock Exchange

- Transparent corporate structure

Cons:

- No banking licence (standard for brokers)

Verdict: Plus500’s combination of FCA regulation, public listing, and 15+ years of operation makes it one of the most secure and transparent CFD brokers available to UK traders.

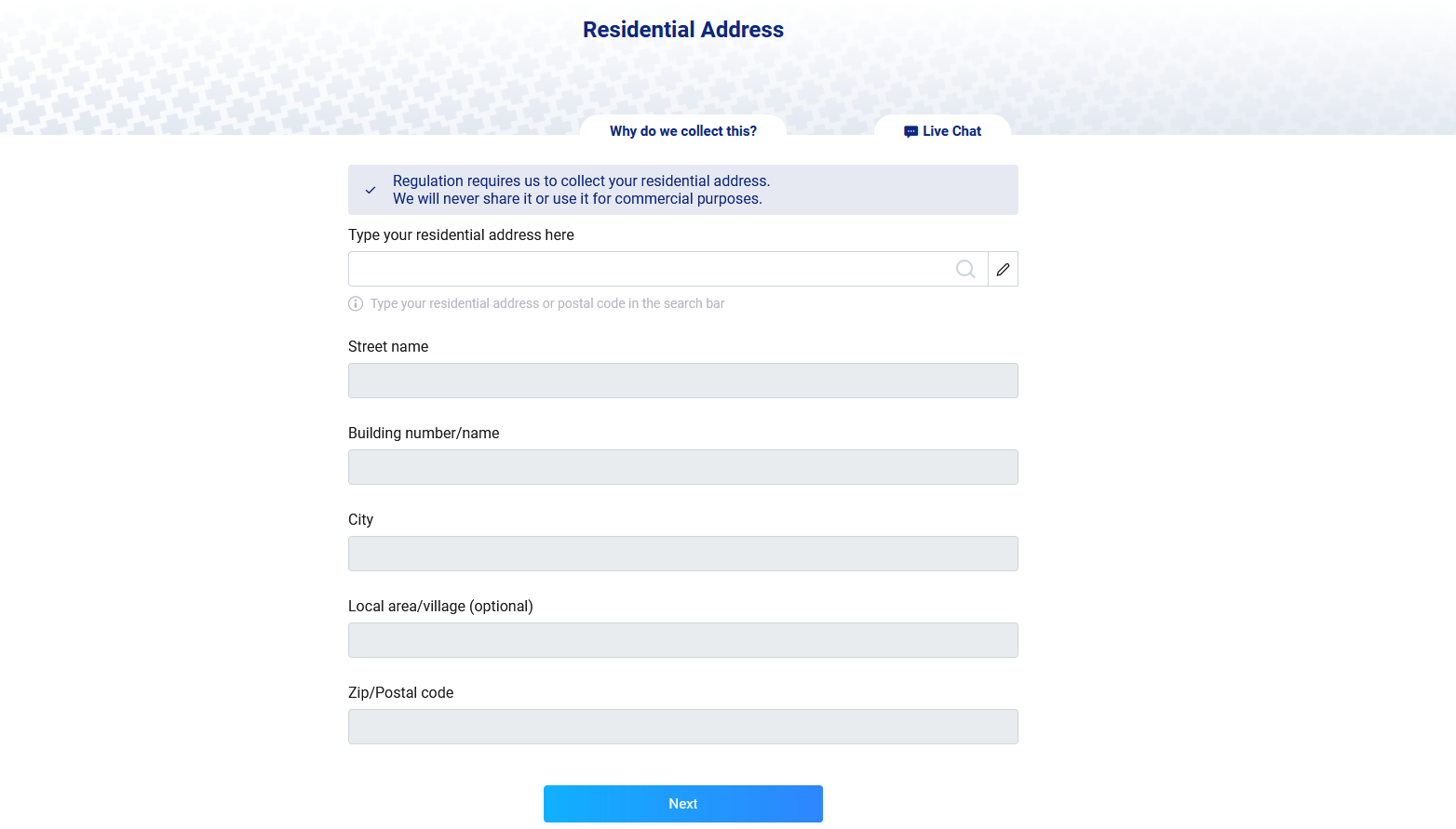

How easy is it to open a Plus500 account?

Overall rating: ★★★★★ (5 / 5)

Opening an account with Plus500 is fast, simple, and beginner-friendly. The entire onboarding process typically takes under 20 minutes, and identity verification is completed within one business day. The platform offers both real and demo accounts, allowing users to start trading or practising immediately.

Account types at Plus500

1. Demo account

The Plus500 demo account is completely free, unlimited, and ideal for both beginners and experienced traders. You can now configure your demo balance up to €40,000 (or equivalent) directly in the app without contacting support. It can also be reset anytime, helping users practise trading strategies and test risk management in a safe, simulated environment.

2. Retail (real money) account

This is the standard account most traders will use. It requires a minimum deposit of £100, which activates full access to live markets. The retail account provides a simple and intuitive interface, making it ideal for everyday CFD trading.

3. Professional account

For eligible traders, Plus500 offers a professional account with higher leverage and potential cash rebates.

To qualify, you must meet at least two of the following:

- Portfolio worth over €500,000 (£430,000)

- Sufficient trading activity in the past year

- Relevant experience in financial services

Most users will be best suited to the retail account, but professional clients benefit from enhanced trading conditions.

Account setup process

Creating a Plus500 account is straightforward and can be done via the mobile trading app or desktop platform:

- Download the Plus500 app (available on iOS, Android, and Windows).

- Enter your personal details.

- Verify your identity using a UK driving licence or passport.

- Verify your residency using a utility bill, bank statement, or tax letter.

- Fund your account with at least £100 to begin trading.

Verification usually takes less than 24 hours, and users can access the demo account instantly while waiting for approval.

Comparison with eToro

Like Plus500, eToro offers both retail and professional accounts, but also includes corporate and Islamic trading accounts, giving users more flexibility. However, Plus500’s simple two-tier system is easier to navigate and faster to set up.

Pros:

- Fast, seamless onboarding (under 20 minutes)

- Free and unlimited demo account

- Professional account available for advanced traders

Cons:

- £100 minimum deposit may deter casual investors

Verdict: Plus500 provides one of the quickest and easiest onboarding experiences among UK CFD brokers. With a free demo mode, intuitive setup, and fast verification, it’s well-suited to both first-time traders and professionals.

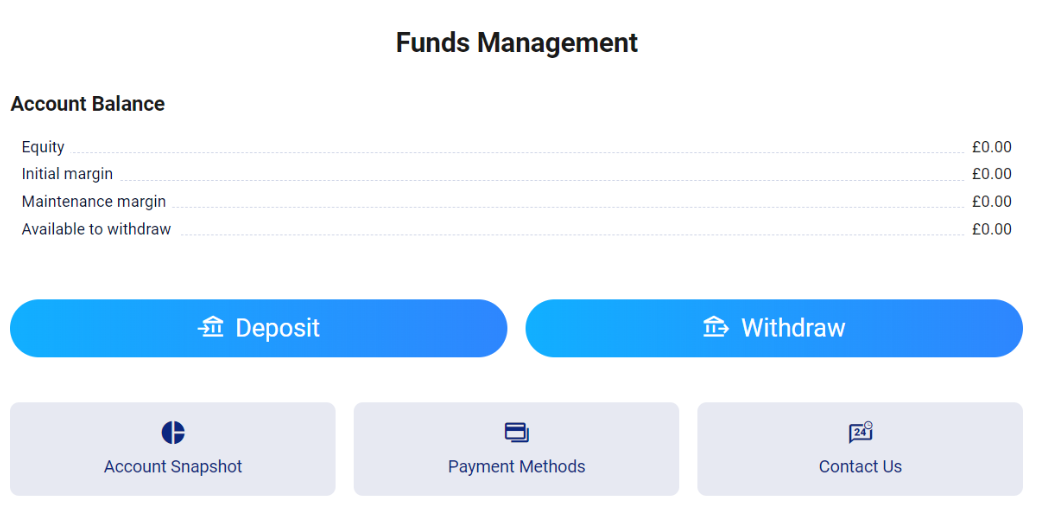

How do deposits and withdrawals work on Plus500?

Overall rating: ★★★★★ (5 / 5)

Depositing and withdrawing funds on Plus500 is fast, secure, and straightforward. The platform supports over 30 base currencies, including GBP, EUR, USD, AUD, CAD, NOK, JPY, and CHF, giving traders flexibility when funding their accounts. Your local currency is set as the default, but you can request a change through customer support to avoid currency conversion fees.

Deposits on Plus500

Deposits are free of charge, and most payment methods process instantly. You can fund your account using:

- Credit or debit card

- Bank transfer / wire transfer

- PayPal

- Apple Pay or Google Pay

The minimum deposit is £100, which is reasonable for most traders but slightly high for beginners testing the platform. Once deposited, funds are immediately available for trading CFDs on the web or mobile platform.

Withdrawals on Plus500

Withdrawals are also free, using the same payment methods as deposits. The minimum withdrawal is £50 for e-wallets (like PayPal) and £100 for bank transfers.

Withdrawals are typically processed within 1–3 business days, though the final transfer speed depends on your payment provider. While Plus500’s payout time is slower than competitors like Trading 212, it remains within industry standards and is known for its reliability and transparency.

Supported currencies

Plus500 supports a wide range of account base currencies, including: AUD, CAD, NOK, EUR, GBP, HUF, JPY, SGD, PLN, CHF, CZK, TRY, SEK, and more.

Choosing your preferred base currency at setup helps you avoid unnecessary conversion fees later.

Pros:

- Over 30 base currencies supported

- Free deposits and withdrawals

- Multiple payment options including PayPal and Apple Pay

Cons:

- Minimum withdrawal could be lower

- Withdrawals can take several business days

Verdict: Plus500 makes managing your funds simple and transparent. With free deposits and withdrawals, multiple currency options, and FCA oversight, it provides one of the most user-friendly fund management experiences among UK CFD brokers.

What markets can you trade on Plus500?

Overall rating: ★★★☆☆ (3 / 5)

Plus500 focuses exclusively on Contract for Difference (CFD) trading, meaning you don’t own the underlying asset but instead speculate on its price movements.

While the platform offers an extensive range of CFDs across global markets, it lacks access to traditional investing options like real stocks, ETFs, or bonds.

Available markets on Plus500

Plus500 currently offers more than 2,800 CFD instruments, covering multiple asset classes:

| Market type | Number of instruments |

|---|---|

| Forex CFDs | 65 currency pairs |

| Stock CFDs | 1,623 global equities |

| ETF CFDs | 97 exchange-traded funds |

| Commodity CFDs | 23 commodities (gold, oil, etc.) |

| Index CFDs | 34 global indices |

| Option CFDs | 22 options, plus 1,000+ underlying assets |

This range provides strong diversification within CFDs, giving traders access to major global markets through a single platform.

Limitations of Plus500 markets

Despite its wide CFD coverage, Plus500 has notable limitations:

- You cannot adjust leverage levels while trading, reducing flexibility for risk management.

- The platform does not support direct stock or ETF investing, nor trading in bonds or futures.

- UK users cannot trade futures contracts, and cryptocurrency CFDs may be restricted depending on jurisdiction.

For traders seeking exposure beyond CFDs, eToro provides a broader selection including real stocks, ETFs, crypto, and commodities, making it more suitable for diversified investors.

Pros and cons

Pros:

- Over 2,800 CFD instruments available

- Strong market diversity within CFDs

- Reliable execution and platform stability

Cons:

- CFDs only — no real shares, ETFs, or bonds

- Leverage levels cannot be adjusted mid-trade

Verdict

Plus500 excels as a dedicated CFD platform, offering access to a wide range of global markets through one interface. However, it falls short for investors seeking long-term or diversified portfolio options. If your goal is pure CFD trading, Plus500 delivers. For broader market access, eToro may be the better choice.

What trading tools does Plus500 offer?

Overall rating: ★★★★☆ (4.5 / 5)

Plus500 provides a solid suite of technical trading tools, including advanced charting, a real-time economic calendar, and a powerful demo account.

However, it lacks deeper research features such as trading ideas, signals, and fundamental data, which may limit advanced users seeking in-depth market insights.

Demo account

The Plus500 demo account is one of the platform’s standout features. It allows you to practice real-time CFD trading with virtual funds, using all the same tools and charts as the live platform. This makes it an excellent way to hone your trading skills and test strategies risk-free.

The demo account can also be reset anytime, letting traders restart their progress or test new methods without restriction. This flexibility makes it ideal for both beginners and experienced traders looking to refine their technical approach.

Charting and research tools

Plus500 includes a strong range of technical analysis tools, offering:

- Over 100 indicators for trend, volume, and volatility analysis

- 20+ drawing tools for precise chart marking

- Customisable and savable charts for future reference

The platform also features an economic calendar, which can be filtered by event type or region to track macroeconomic and company updates. This is especially useful for traders following interest rate decisions or earnings releases.

Another useful addition is +Insights, a real-time data tool showing the most popular assets being traded on Plus500, sortable by location, time frame, and instrument type. It provides a clear snapshot of trader sentiment within the platform’s ecosystem.

Missing features

Despite its technical strengths, Plus500 lacks certain research capabilities found on more comprehensive trading platforms:

- No trading signals or automated alerts

- No fundamental analysis tools or company data

- No integration with algorithmic or third-party analysis software

Adding these would enhance Plus500’s appeal to professional traders seeking deeper research and automation.

Pros and cons

Pros:

- Excellent demo account with full platform access

- Advanced charting with 100+ indicators

- Informative economic calendar and +Insights feature

Cons:

- No trading ideas, signals, or fundamental data

- No external analytics or algorithmic tools

Verdict

Plus500 delivers excellent technical analysis tools and a market-leading demo environment, making it perfect for traders who rely on chart-based strategies. However, the absence of fundamental research tools means it’s best suited for technically focused CFD traders rather than those seeking deep market research.

How does the Plus500 trading platform perform?

Overall rating: ★★★★☆ (4.5 / 5)

The Plus500 trading platform stands out as one of the most intuitive and user-friendly CFD trading platforms in the UK.

Available on both web and mobile, it offers seamless functionality, powerful charting tools, and a clean design suitable for both beginners and experienced traders. However, it lacks some advanced customisation options and external integrations like MT4 or copy trading.

Web platform

The Plus500 web platform combines a sleek, modern interface with practical usability. Traders can switch between light and dark modes, making long trading sessions easier on the eyes.

Navigation is effortless, assets, tools, and settings are all accessible via a simple search bar and structured menus.

A standout feature is the Multiscreen Charts tool, which allows you to monitor up to 25 instruments simultaneously. You can customise each chart with different indicators, drawing tools, and layouts, enabling real-time analysis across multiple markets.

While overall customisation is somewhat limited, the platform still offers excellent functionality for CFD trading.

Mobile platform

The Plus500 mobile app mirrors the web platform’s layout and functionality, ensuring a consistent trading experience across devices. Available for both iOS and Android, it includes full chart access, intuitive navigation, and push notifications for key price movements or open positions.

The app supports both light and dark modes, and its layout, with menus fixed at the bottom of the screen, makes it easy to trade on the go.

While it lacks deeper customisation features, it remains one of the smoothest and most reliable CFD trading apps in the UK.

Making a trade

Placing a trade on Plus500 is straightforward. Simply:

- Select the CFD instrument you want to trade.

- Click ‘Trade’ and set your position size.

- Choose whether to close at profit or loss using built-in risk controls.

- Review ‘Info’ and ‘+Insights’ tabs for live data before confirming your order.

Traders can also use advanced order types such as Trailing Stops and Buy/Sell at Rate, which help manage risk and automate entry points.

User experience

Overall, the Plus500 trading experience is smooth, efficient, and reliable. The consistent design between web and mobile makes switching between devices effortless, while charting tools and indicators provide valuable support for day traders and technical analysts.

However, Plus500 does not support desktop platforms, copy trading, or third-party tools like MetaTrader 4 (MT4), features often preferred by professional traders seeking advanced customisation.

Pros and cons

Pros:

- Easy to use and beginner-friendly

- Consistent design across web and mobile

- Powerful Multiscreen Charts and risk management tools

- Excellent choice for CFD day trading

Cons:

- No desktop version available

- No MT4 or copy trading support

- Limited platform customisation

Verdict

Plus500 delivers an exceptional CFD trading experience, combining a polished interface with powerful tools and smooth functionality. It’s best suited to traders who value simplicity, speed, and real-time market access, rather than those seeking complex or automated strategies.

How good is Plus500’s educational content?

Overall rating: ★★★★☆ (4.5 / 5)

Plus500 has made strong progress in improving its educational offering through the launch of its Trading Academy, which features videos, articles, and webinars designed to help users learn the fundamentals of CFD trading. However, while the content is useful for beginners, the library remains limited compared to competitors such as eToro or IG Academy.

Trading Academy

The Plus500 Trading Academy is the platform’s main learning hub. It includes a mix of video tutorials, articles, and guides covering trading strategies, risk management, and market analysis. All content is free to access and tailored for users who want to understand how CFDs and leverage work before trading with real money.

Traders can also access free webinars hosted by The Corellian Academy, available to all Plus500 clients (with a one-week delay). These sessions add expert-led insight into trading psychology and market behaviour.

Additional learning resources

Beyond the Trading Academy, Plus500 offers a Trader Guide section, which includes a short eBook and practical videos explaining trading concepts and platform use. The News and Market section also helps users stay updated with real-time events and price movements, supporting informed decision-making.

However, the range of content is still quite limited, fewer than 15 lessons and videos are currently available. Much of the material focuses on platform navigation rather than broader trading education or advanced strategy.

Future improvements

Plus500 has announced plans to expand its educational tools by adding:

- Interactive quizzes and trading simulations to make learning more engaging

- Collaborations with professional traders and analysts to enhance course quality

- Expanded video content and expert-led webinars with a focus on practical trading experience

These upcoming additions will likely strengthen the Trading Academy and make it more valuable for developing traders.

Pros and cons

Pros:

- Dedicated Trading Academy with free access

- Free eBook and Corellian Academy webinars

- News and market updates integrated within the platform

Cons:

- Limited quantity and depth of content

- Focused more on platform use than trading theory

Verdict

Plus500’s educational tools are useful but basic, providing a solid starting point for beginners. The Trading Academy offers essential training in a clear and structured way, but experienced traders may find the material too limited. Future updates and expert collaborations could make it a more comprehensive and interactive learning hub.

How good is Plus500’s customer service?

Overall rating: ★★★★★ (5 / 5)

Plus500 provides excellent customer support, offering fast, reliable, and knowledgeable assistance across multiple channels.

The platform’s 24/7 live chat and email support ensure that traders can get help whenever they need it, often within minutes.

Support availability

Plus500’s customer service operates 24 hours a day, 7 days a week, making it one of the most accessible support systems among CFD brokers. This round-the-clock coverage ensures that traders in any time zone can resolve issues without delay.

Contact options

You can reach Plus500’s support team through several convenient methods:

- Live chat (directly via the platform or app)

- WhatsApp messaging

- Email support

When tested, the live chat feature connected within seconds, and responses were detailed and accurate, resolving issues in just a few minutes. Email replies were also impressive, with clear and helpful answers typically arriving within one hour — much faster than the industry average.

The only missing option is telephone support, which could be useful for complex issues. However, given the efficiency of live chat and email, this omission is unlikely to affect most users.

Service quality

Plus500’s support team is well-trained, knowledgeable about both the platform and CFD trading, and capable of handling technical or account-related questions with ease. The tone of communication is professional yet approachable, and users frequently report positive, problem-free experiences.

Pros and cons

Pros:

- 24/7 customer support

- Fast response times via chat and email

- Knowledgeable and professional support agents

Cons:

- No direct phone support available

Verdict

Plus500’s customer service ranks among the best in the UK trading market. With rapid response times, multiple contact options, and knowledgeable staff available 24/7, it provides traders with confidence and peace of mind. While the lack of phone support is a minor drawback, the live chat and email systems are more than sufficient for most users.

Who is Plus500 best suited for?

Plus500 is best for traders who want a simple, reliable, and regulated platform for CFD trading. It’s particularly well-suited to users who already understand how CFDs and leverage work, but it also offers a free demo account for beginners to practise safely.

Plus500 is ideal for:

- Experienced CFD traders who value low fees, tight spreads, and advanced charting tools.

- Intermediate traders seeking a user-friendly, FCA-regulated platform with a strong reputation for transparency.

- Beginners who want to learn with a free, unlimited demo account before trading real money.

- Day traders who benefit from fast execution, real-time data, and access to over 2,800 CFD instruments.

However, Plus500 is not recommended for long-term investors or anyone looking to buy and hold real assets such as stocks, ETFs, or bonds, since it offers CFD trading only.

Verdict: Plus500 is best for traders focused on short-term speculation, technical analysis, and leveraged CFD strategies within a safe and regulated environment.

Final thoughts

Plus500 is a trusted, FCA-regulated CFD trading platform offering a smooth experience across web and mobile.

With low fees, strong charting tools, and excellent customer support, it’s a top choice for active and intermediate traders.

However, as a CFD-only broker, it’s not suited to long-term investors looking to buy real stocks or ETFs.

FAQs

Is Plus500 good in the UK?

Plus500 is a well-known online trading platform and is commonly used in the UK. It offers a user-friendly interface, a wide range of financial instruments, and competitive pricing.

How long do Plus500 withdrawals take in the UK?

Withdrawals from Plus500 to a bank account in the UK generally take around 5-7 business days from the authorisation of the withdrawal. However, it’s important to note that withdrawals to a bank account can occasionally experience additional delays depending on the banking institution and jurisdiction involved.

Is Plus500 reliable?

Yes, Plus500 is considered highly reliable. It is regulated by six global regulators, including the FCA and ASIC, indicating a high level of trustworthiness and reliability in its operations. Plus500 is also publicly traded and does not operate as a bank.

Is Plus500 good for beginners?

Yes, Plus500 is suitable for beginners, offering a user-friendly platform and a range of educational resources. However, it’s crucial for new traders first to use the demo account and participate in the Trading Academy to gain the necessary experience before trading with real capital, due to the risks involved.

Can Plus500 be trusted?

Yes. Plus500 is FCA-regulated (FRN 509909) and listed on the London Stock Exchange, making it a highly trusted and transparent CFD broker.

Is it easy to withdraw money from Plus500?

Yes. Withdrawals are free and simple, usually processed within 1–3 business days to the same payment method used for deposits.

What are the risks of investing in Plus500?

The main risk is CFD trading itself. CFDs are leveraged products, meaning you can lose money quickly. 80% of retail accounts lose money when trading CFDs with Plus500.

Does Plus500 work in the UK?

Yes. Plus500 is fully authorised and regulated by the UK’s Financial Conduct Authority (FCA) and legally operates across the UK.

Is Plus500 good for beginners?

Yes, to an extent. It offers a free demo account and a user-friendly interface, but beginners should study CFD risks carefully before trading with real money.

Does Plus500 pay out?

Yes. Plus500 pays out profits to verified accounts, with withdrawals processed quickly and transparently to linked payment methods.