Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

IG is one of the UK’s most established and FCA-regulated trading platforms, trusted by both beginners and professionals.

It offers access to over 17,000 markets, including forex, stocks, indices, and CFDs, making it one of the most comprehensive brokers available.

This review explains everything you need to know about IG, from fees, spreads, and regulation to its mobile app, trading tools, and customer support.

Each section is rated using a points-based scoring system, so you can clearly see how IG performs across key areas before deciding if it’s the right platform for you.

For more information on how we test view here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

How does IG perform overall?

Overall rating: 4.5 stars

IG ranks as one of the best trading platforms in the UK, offering a secure, FCA-regulated environment and access to a wide range of markets. Its trading tools, platform design, and educational resources are exceptional, making it ideal for active traders and professionals alike.

However, higher fees and limited customer support options may disappoint users seeking lower-cost or faster-response alternatives.

| Category | Points | Star rating |

|---|---|---|

| Fees | 6.3 | ⭐⭐⭐ |

| Safety | 9.8 | ⭐⭐⭐⭐⭐ |

| Onboarding | 8.8 | ⭐⭐⭐⭐½ |

| Deposit & withdrawal methods | 9.5 | ⭐⭐⭐⭐⭐ |

| Markets | 8.8 | ⭐⭐⭐⭐½ |

| Tools | 9.4 | ⭐⭐⭐⭐⭐ |

| Investment & trading platform | 9.6 | ⭐⭐⭐⭐⭐ |

| Education | 9.6 | ⭐⭐⭐⭐⭐ |

| Customer service | 6.2 | ⭐⭐⭐ |

Final verdict: IG delivers near-flawless functionality, but its premium pricing means it best suits serious or experienced traders.

How much does it cost to trade with IG?

Rating: 3 stars

IG’s trading fees are higher than most competitors, especially for CFDs and real shares. However, it stands out for having no deposit or withdrawal fees, making it more cost-effective for active users.

Deposit and withdrawal fees

Depositing and withdrawing money on IG is completely free, which is a major plus compared to platforms like eToro, which charges £5 per withdrawal.

An inactivity fee of £24 per quarter applies after two years of no activity, but simply logging in and placing a trade resets the timer.

While this fee is rare among brokers, it benefits long-term investors who hold positions without frequent trading. Competing platforms like Plus500 charge £7.54 per month after just three months of inactivity, so IG is better for “set and forget” traders.

Real stocks and shares fees

IG charges £8 per UK trade and £10 per US trade, both of which drop to £3 when making three or more trades per month. This makes IG more rewarding for active traders, though casual investors may find cheaper options on Trading 212 or Freetrade.

CFD trading fees

IG’s CFD fees are higher than average. For example, trading $2,000 of Apple CFDs can cost around $15, compared with $2 on eToro. This could deter cost-conscious traders who deal primarily in CFDs.

Forex fees

In contrast, forex trading fees are highly competitive. IG offers a GBP/USD spread of 0.9 pips, compared to 2.0 pips on eToro, making it a strong choice for currency traders.

Custody and Smart Portfolio fees

A custody fee of £24 per quarter (£96 per year) applies, but it’s waived if you make three or more trades per quarter.

For passive investors, IG’s Smart Portfolios, managed by BlackRock, charge a Total Cost of Ownership fee, which includes management, ETF, and spread costs.

Pros:

- No deposit or withdrawal fees

- Trading fees can be reduced with frequent activity

Cons:

- Inactivity fee after two years

- Custody charge for low-activity users

- Higher CFD and stock trading costs than some competitors

Verdict: IG’s pricing rewards active traders but may feel expensive for casual investors or those making occasional trades.

Is IG a safe trading platform?

Rating: 5 stars

Yes, IG is one of the safest trading platforms in the UK. It’s regulated by the Financial Conduct Authority (FCA), ensuring all client funds are handled securely and the company operates transparently and fairly.

IG is also a publicly listed company on the London Stock Exchange (LSE), meaning its financial performance and governance are regularly audited and available for public review. Founded in 1974, IG has built a 50-year track record of stability, including surviving the 2008 financial crisis.

Although IG does not hold a banking licence, this is common for investment firms and does not affect the platform’s credibility. UK users should note that negative balance protection no longer applies post-Brexit, so it’s important to monitor your account balance regularly to avoid losses beyond your deposit.

Pros:

- Regulated by the FCA

- Listed on the London Stock Exchange

- Nearly 50 years of trusted operation

Cons:

- No banking licence

- No negative balance protection for UK clients

Verdict: IG’s long history, regulation, and public transparency make it one of the most trusted and secure brokers in the UK.

How easy is it to open an account with IG?

Rating: 4.5 stars

Opening an account with IG is straightforward and beginner-friendly, though the verification process takes slightly longer than other brokers. The setup is fully digital, and most users can complete it within minutes.

Account opening process

You can create an IG account via the website or mobile app by entering your contact details, residence, and preferred account type. UK users can choose from three main account options:

- Spread betting

- CFD trading

- Share dealing

You can open one or all of these simultaneously, giving you flexibility across different investment types. IG offers more variety than Plus500, which focuses mainly on CFDs, but fewer asset classes than eToro, which also includes crypto, ETFs, and bonds.

Once you’ve selected your account type, IG will ask for details about your employment, income, and financial experience. If your answers fall short of IG’s suitability standards, your application may be declined, although this is rare for most users.

Verification

Next, you’ll take a short financial aptitude test to confirm your understanding of trading basics. After that, you’ll need to verify your identity using a passport or driving licence and proof of address, such as a utility bill or bank statement.

Uploading documents is quick and simple, but final verification can take up to two business days, which is slower than competitors like Trading 212 or eToro.

Pros:

- Simple, user-friendly signup process

- Comprehensive compliance checks for security

Cons:

- Verification can take a few days

- Accounts may be rejected based on financial profile

Verdict: IG offers a smooth and secure onboarding experience, ideal for those who value compliance and flexibility over instant access.

How can you deposit and withdraw money with IG?

Rating: 5 stars

Depositing and withdrawing funds on IG is fast, secure, and completely free. The platform supports several popular payment options, making it convenient for UK traders to move money in and out of their accounts.

Deposits

You can fund your IG account using:

- Debit or credit card

- Bank transfer

- PayPal

- Prepaid cards

Deposits are fee-free, and funds usually appear instantly for card and PayPal payments. The minimum deposit is £250 for debit or credit cards, while bank transfers have no minimum, making them ideal for smaller deposits.

The only drawback is that your base currency is fixed to your region (GBP for UK users). Changing it requires contacting customer support by email, which can be inconvenient.

Withdrawals

Withdrawals are just as straightforward. You can withdraw via the same methods, and IG charges no withdrawal fees, unlike eToro, which charges a £5 fee per withdrawal.

Withdrawals typically take 1–3 business days, depending on the payment method and your bank’s processing times.

Pros:

- No deposit or withdrawal fees

- Wide range of supported payment methods

- No minimum deposit when using bank transfer

Cons:

- Changing base currency requires email request

Verdict: IG’s fee-free deposits and withdrawals and flexible funding options make it one of the most user-friendly brokers for managing your trading funds.

What markets can you trade on IG?

Rating: 4.5 stars

IG offers an impressive range of markets, giving UK traders access to thousands of instruments across stocks, ETFs, CFDs, forex, and commodities. However, bonds, options, and crypto trading remain limited for most retail users.

Real stocks and ETFs

UK investors can trade over 13,000 stocks and investment trusts across 17 global markets, along with 6,000 ETFs, a wider range than most competitors, including eToro.

This gives traders a strong foundation for building diversified portfolios that suit different risk levels and investment goals.

CFDs and forex

IG is one of the largest CFD providers in the UK, with access to:

- 10,500 stock CFDs

- 100 stock index CFDs

- 1,900 ETF CFDs

- 47 commodity CFDs

- 12 bond CFDs

Forex traders can choose from 98 currency pairs, offering more depth than platforms like Plus500. Tight spreads and professional-grade tools make IG a top choice for serious currency traders.

Crypto trading

Cryptocurrency trading is only available to professional clients who meet strict eligibility criteria, such as holding a €500,000+ financial portfolio. Retail traders are restricted from crypto CFDs under FCA regulations, but those seeking digital assets may prefer eToro, which offers crypto access to all users.

Bonds and options

Bonds and options trading are not available to UK retail clients. This limits diversification for traders who want exposure to fixed-income or derivative products.

Smart Portfolios

IG’s Smart Portfolios, managed by BlackRock, provide a simple way to invest in diversified ETF portfolios. UK users can choose from five ready-made portfolios, making this feature ideal for hands-off investors seeking long-term growth.

Pros:

- Excellent range of markets and asset classes

- Smart Portfolios managed by BlackRock

- Access to over 13,000 global stocks and 98 forex pairs

Cons:

- No crypto access for retail clients

- Bonds and options not available in the UK

Verdict: IG’s market range is exceptional for most traders, especially those focusing on stocks, forex, and CFDs, but limited for users seeking crypto or fixed-income exposure.

What trading tools does IG offer?

Rating: 5 stars

IG provides one of the most comprehensive toolsets of any UK trading platform. From advanced charting to real-time news and a built-in trader community, it gives users everything they need to trade confidently and stay informed.

Research and charting tools

IG’s platform includes 32 technical indicators and highly customisable interactive charts.

You can edit, save, and annotate charts, as well as mark key economic events to plan trades around market-moving data.

The ‘Signals’ tab provides actionable trading ideas, which are clear, data-backed, and updated regularly.

You can also access fundamental analysis on most assets, allowing for deeper research before executing trades.

News and market insights

IG’s news feed, powered by Thomson Reuters, delivers real-time market updates directly within the trading dashboard.

It also features trending posts from X (formerly Twitter), helping traders gauge market sentiment quickly.

For visual learners, IGTV provides up to four daily video updates, offering concise analysis of global market events.

However, this feature is only available on the web platform, not the mobile app.

Community platform

IG also hosts an active community forum, where traders can share strategies, ask questions, and exchange insights.

It’s especially valuable for beginners seeking support or feedback from more experienced users.

Pros:

- Excellent charting and technical tools

- Access to real-time fundamental data and signals

- Innovative trader community for collaboration

- Thomson Reuters news feed and daily video updates

Cons:

- News and IGTV features unavailable on the mobile app

Verdict: IG’s professional-grade research tools, community features, and integrated insights make it one of the best platforms in the UK for both new and experienced traders.

How good is IG’s trading platform?

Rating: 5 stars

IG offers one of the best trading platforms in the UK, combining a clean interface, advanced tools, and smooth functionality across both web and mobile. Trading is fast, intuitive, and fully customisable, making it ideal for beginners and professionals alike.

Web platform

The web platform stands out for its simple, well-organised design. You can easily find any market or asset using the search bar or menu navigation, and the dashboard can be customised to suit your trading style.

Tabs can be rearranged, one-click trading can be enabled, and you can set price or indicator alerts for key market movements.

IG also supports detailed notifications for price changes, position updates, and economic events, helping traders stay informed in real time.

Mobile platform

The mobile trading app mirrors the web version, offering the same usability and sleek layout. While a few features like the news feed are missing, it still provides fast execution, charting tools, and price alerts. The app is suitable for managing trades on the go without sacrificing performance.

Making a trade

Placing a trade on IG is simple and efficient. You can open a position in just a few clicks using market, limit, stop, trailing stop, or guaranteed stop orders. Time limits like GTC (Good Till Cancelled) and GTD (Good Till Date) are also supported for better order control.

The platform supports MetaTrader 4 (MT4) integration, allowing traders to use familiar tools and expert advisors for automated trading.

Overall experience

IG delivers a smooth, professional-grade trading experience. The charting tools and indicators are among the best in the market, and execution speed is excellent, even for day traders. The only drawback is that mobile users miss out on a few advanced features.

Pros:

- Excellent web and mobile trading platforms

- Easy, intuitive trading process

- Fully customisable dashboard and alerts

Cons:

- Some web features missing from the mobile app

Verdict: IG’s platform combines power with simplicity, offering a seamless experience across devices and supporting both active traders and long-term investors.

What educational resources does IG offer?

Rating: 5 stars

IG provides one of the most comprehensive educational suites of any UK trading platform. Its structured courses, live webinars, and demo account make it ideal for traders of all experience levels.

Learning resources

IG’s education hub is divided into three skill levels: beginner, intermediate, and advanced. Each section includes videos, tutorials, and articles tailored to your trading knowledge.

You can also join live webinars and workshops, where experts cover topics ranging from market analysis to trading psychology.

This level of educational support places IG ahead of most UK brokers, giving users the tools to learn, improve, and make informed decisions.

Demo account

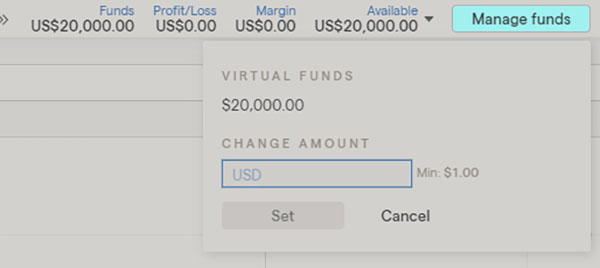

IG also offers a free demo trading account, allowing you to practise trading with virtual funds before risking real capital.

It mirrors the live platform experience, making it perfect for testing strategies or exploring the platform’s features.

However, the demo account is limited to CFD trading only and does not support traditional share dealing. Users focusing on real stock investing may need to explore other learning methods.

Pros:

- Structured learning for all levels

- High-quality webinars and tutorials

- Excellent demo account for practice

Cons:

- Demo account limited to CFD trades only

Verdict: IG’s education and training resources are outstanding, offering both structured learning and practical experience through its demo platform. It’s one of the best choices for traders who want to learn and grow with confidence.

How good is IG’s customer service?

Rating: 3 stars

IG offers multiple support channels, including live chat, phone, and email, but overall responsiveness and availability could be improved.

While agents are knowledgeable, the experience doesn’t always match the efficiency expected from a leading UK broker.

Phone support

IG is one of the few trading platforms that still provides phone support, but the service can feel slow and inconsistent. Wait times often last several minutes, and users report mixed experiences in getting clear answers from agents.

Email support

Email support is available 24 hours a day, but responses typically take up to one business day. The replies are detailed and accurate once received, but the delay may frustrate users who need faster assistance.

Live chat

IG’s live chat is advertised as 24/7, yet in practice, it is only active during peak trading hours. Even when available, users may wait several minutes to connect. Once connected, the agents are helpful and resolve most issues effectively.

Pros:

- Offers phone, email, and live chat support

- Accurate and informative responses from agents

Cons:

- Live chat not available 24/7 as advertised

- Email responses can be slow

- Long wait times on phone support

Verdict: IG’s customer service team is knowledgeable and professional but lacks consistency in response times and availability. Traders who value instant assistance may prefer brokers with more reliable 24/7 support.

Who is IG best suited for?

IG is best suited for experienced and active traders who want access to advanced tools, deep market coverage, and professional-grade platforms. Its extensive range of CFDs, forex pairs, and global stocks make it ideal for users who value market variety and analytical depth.

The platform also appeals to learners and long-term investors thanks to its high-quality educational resources, Smart Portfolios, and demo account.

However, beginners looking for simple, low-cost trading may find IG’s fees and verification process less appealing than more beginner-focused platforms like Trading 212 or eToro.

Best for:

- Active traders and professionals

- Forex and CFD traders

- Investors seeking advanced tools and analytics

- Learners who want strong educational resources

Not ideal for:

- Casual investors making a few trades per year

- Users prioritising low fees or instant account setup

Verdict: IG is a trusted, FCA-regulated platform built for traders who want depth, reliability, and powerful tools to trade across global markets.

Final thoughts

IG stands out as a trusted, FCA-regulated trading platform with powerful tools, diverse markets, and exceptional educational resources.

It’s best for active or experienced traders who value advanced features and reliability.

However, its higher fees and limited customer support may not suit everyone.

Overall, IG remains one of the most comprehensive and professional trading platforms available in the UK.

FAQs

Is IG a good broker for the UK?

Yes. IG is one of the best UK brokers, offering a wide range of markets, advanced tools, and FCA regulation.

Is IG trustworthy?

Yes. IG is a publicly listed, FCA-regulated company with nearly 50 years of proven reliability and transparent operations.

Is my money safe with IG?

Yes. Client funds are held in segregated bank accounts under FCA rules, ensuring protection if IG faces financial issues.

Is IG better than Trading 212?

IG offers more markets and professional tools, while Trading 212 is better for beginners seeking commission-free trading and simplicity.

Is IG regulated in the UK?

Yes. IG is regulated by the Financial Conduct Authority (FCA) under licence number 195355.

Is IG good for beginners?

Partially. IG provides excellent education and a demo account, but its fees and complexity may be challenging for complete beginners.