To buy Ethereum in the UK, sign up with a regulated cryptocurrency exchange platform like eToro, Bitpanda, or Coinbase. Complete identity verification (KYC), link a payment method such as a bank account or debit card, and purchase Ethereum by selecting the amount and confirming the transaction.

Buying Ethereum in the UK is gaining popularity as crypto enthusiasts explore its potential beyond trading, including decentralised applications.

With growing interest from major financial institutions and evolving UK regulations, now is a great time to learn how to buy Ethereum.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

How to Buy Ethereum in the UK Step-by-Step

You can follow these steps to purchase ETH legally and securely:

- Choose an FCA-Registered Platform. The Financial Conduct Authority (FCA) requires cryptoasset service providers in the UK to undergo registration (1). Make sure to register on a platform that complies with UK regulations. For a deeper look into reputable providers, check out our guide on the best crypto exchange in the UK. Popular platforms include eToro, Bitpanda, Coinbase, and Uphold.

- Sign Up & Complete KYC. FCA regulations mandate Know Your Customer (KYC) procedures, requiring you to verify your identity (passport, driver’s licence, or national ID). This process ensures a safer trading environment and helps prevent fraud.

- Deposit Funds. You can deposit GBP through bank transfers or debit/credit cards. Bank transfers are often cheaper, but cards can be quicker. Some exchanges even offer instant deposits via Faster Payments.

- Place an Order for Ethereum (ETH). Once your funds are available, locate the ETH/GBP trading pair and place a market or limit order. A market order buys Ethereum at the current market price, while a limit order lets you specify your desired purchase price.

- Transfer & Store Securely. After the purchase, move your ETH off the exchange into a personal wallet for maximum security.

Which Platforms Are Popular in the UK?

- eToro: FCA-registered, simple interface, allows social trading.

- Coinbase: Ideal for beginners; supports bank transfers and card payments.

- Bitpanda: Offers recurring investment plans and staking.

- Uphold: Provides multi-asset trading, including crypto, stocks, and metals.

Quick Comparison Table

| Exchange | Trading Fees | Deposit Methods | Notable Features |

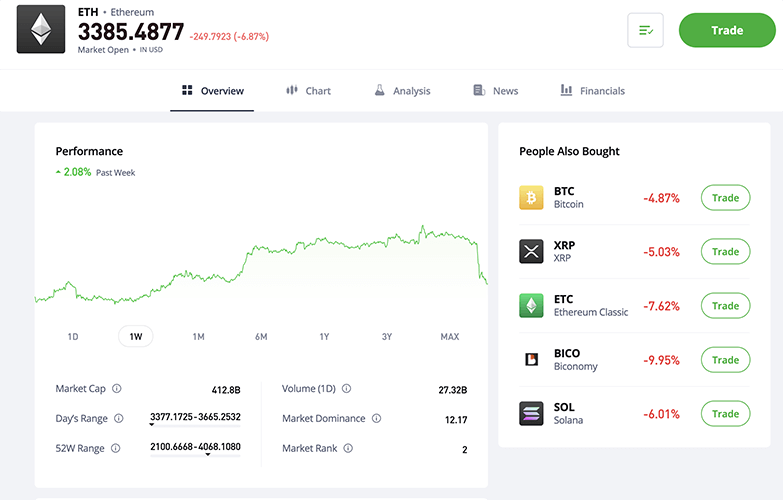

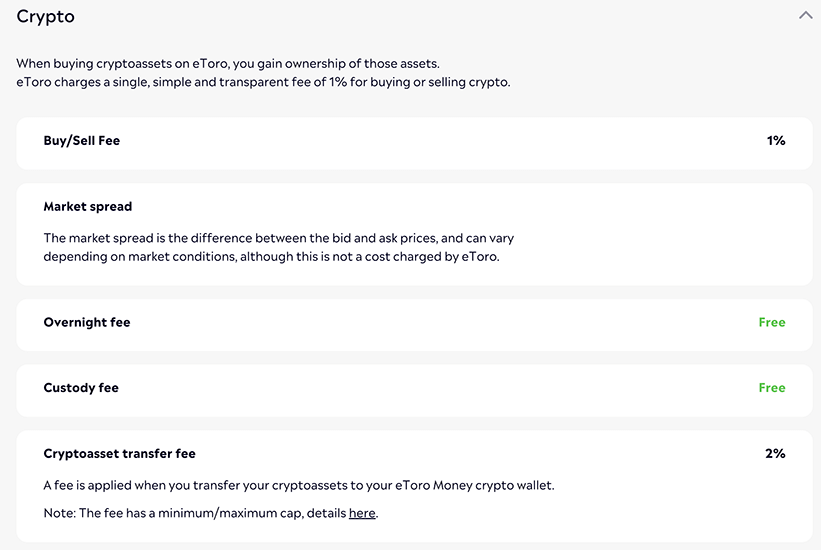

| eToro | 1% (spread) | Bank transfer, card | Social Copy Trading |

| Bitpanda | 0.99–2.49% | Card, PayPal, Apple Pay | Staking, auto investing |

| Coinbase | 0.5–1.5% | Bank transfer, card | Beginner-friendly |

| Uphold | ~0.9% (spread) | Bank transfer, card | Multi-asset support |

Store Ethereum Safely

Should I Use a Hot or Cold Wallet?

- Hot Wallets: Connected to the internet; convenient but less secure.

- Cold Wallets: Hardware or offline devices that provide maximum protection from online threats.

For long-term storage, use hardware wallets such as Ledger Nano X or Trezor Model T.

How Do I Withdraw ETH to a Personal Wallet?

Go to your exchange’s withdrawal section, enter your wallet address, confirm with 2FA, and finalise the transfer. Always double-check the address to avoid irreversible errors.

Key Takeaways

- Ethereum is more than just a digital coin; it powers a decentralised network of applications.

- Buying Ethereum involves choosing a reliable FCA-regulated exchange, transferring funds, and storing it securely in a reputable wallet.

- What’s the fastest way to invest in Ethereum in the UK? Most UK investors use popular crypto apps, platforms or exchanges (such as eToro, Coinbase, or Uphold) that allow instant bank transfers or credit/debit cards for quick purchases.

- Ethereum sales in the UK may be subject to Capital Gains Tax; consult HMRC for up-to-date guidance.

How Does Ethereum Work

Ethereum operates as a decentralised blockchain platform that powers not only a digital currency but an entire programmable ecosystem. Its key innovation lies in the ability to execute smart contracts — self-executing code that automatically performs predefined actions once conditions are met. This functionality forms the foundation for a wide range of decentralised applications (dApps), including finance, gaming, and supply-chain systems.

The Shift to Proof-of-Stake (PoS)

In 2022, Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS) in an event known as The Merge. Under the old PoW model, miners competed to solve cryptographic puzzles, consuming vast energy resources. PoS replaced miners with validators — users who stake ETH to secure the network and confirm transactions.

This shift:

- Reduced Ethereum’s energy consumption by over 99%, improving its environmental profile.

- Lowered entry barriers for network participation, encouraging decentralisation.

- Introduced staking yields, turning ETH into an income-generating asset for long-term holders.

From an investment perspective, the move to PoS transformed Ethereum into a yield-bearing digital asset, aligning it more closely with traditional fixed-income instruments while retaining exposure to crypto market growth.

Transaction Fee Model and “Gas”

Every Ethereum transaction requires a gas fee, paid in ETH. Gas represents the computational cost of executing operations on the blockchain — such as transferring tokens or interacting with DeFi protocols.

After the EIP-1559 upgrade, Ethereum began burning a portion of each gas fee, effectively reducing the total supply of ETH over time. This deflationary mechanism creates a new investment dynamic: when network activity is high, more ETH is burned, tightening supply and potentially supporting price appreciation.

For investors, this means Ethereum’s value is influenced not only by demand but also by on-chain activity levels — a fundamental difference from fixed-supply assets like Bitcoin.

The DeFi and NFT Ecosystem

Ethereum’s smart-contract infrastructure underpins the majority of decentralised finance (DeFi) and non-fungible token (NFT) markets.

- DeFi protocols such as lending, staking, and decentralised exchanges (DEXs) operate autonomously on Ethereum, generating liquidity and transaction volume that feed back into ETH demand.

- NFT platforms, built on Ethereum standards like ERC-721, created an entirely new digital-asset market, strengthening Ethereum’s role as the settlement layer for creative and commercial activity.

Together, these ecosystems drive consistent usage of the Ethereum network — translating directly into transaction fees, staking rewards, and network security — all key value drivers for long-term investors.

Investment Case and Risk Vectors

Investment Case:

- Ongoing PoS yields provide recurring returns in addition to capital appreciation.

- The burn mechanism supports a gradually deflationary supply model.

- Widespread DeFi and NFT adoption reinforces Ethereum’s dominance as the base layer of Web3.

- Institutional products (ETNs and future ETFs) continue to expand regulated exposure.

Risk Vectors:

Competition: Layer-1 rivals (e.g., Solana, Avalanche) and Layer-2 scaling solutions could fragment liquidity and user activity.

Scalability pressure: Network congestion can increase gas fees and deter adoption.

Regulatory uncertainty: Future UK and global regulations may alter exchange or staking operations.

Smart-contract vulnerabilities: Bugs in third-party dApps can lead to fund loss even if Ethereum itself remains secure.

Why Ethereum is Gaining Popularity

Ethereum is not just a cryptocurrency, it’s a programmable blockchain on which developers can create decentralised applications (dApps).

According to a 2022 study by the University of Cambridge, the number of dApps has grown exponentially, leading to increased usage of ETH for transaction fees (often called ‘gas’) within the network.

Beyond dApps, Ethereum supports decentralised finance (DeFi) protocols, non-fungible tokens (NFTs), and more.

These innovations have attracted both individual investors and institutional interest, making how to buy Ethereum in the UK a top query for people looking to get in on the action early.

In my experience, Ethereum’s dApp ecosystem opened my eyes to real-world use cases of blockchain technology, unlike some other tokens that primarily rely on hype.

Ethereum Price in the UK and Market Factors

Ethereum’s price in the UK reflects the same global forces driving crypto markets worldwide, but it’s quoted in GBP when using a UK-based exchange or trading app. The value of ETH fluctuates daily, shaped by both international market sentiment and domestic economic conditions.

Key Factors Influencing Ethereum’s Price

- Network Upgrades: Ethereum’s transition from Proof of Work to Proof of Stake (PoS) through The Merge has reduced energy consumption by over 99% and enhanced scalability. Ongoing upgrades, such as Proto-Danksharding and Layer-2 rollups, are designed to further lower transaction costs and boost throughput — key to Ethereum’s competitiveness against newer blockchains.

- Regulatory Developments: Crypto regulation in the UK continues to evolve. The Financial Conduct Authority (FCA) oversees registration and anti-money laundering compliance for exchanges, while HM Treasury is developing a comprehensive Cryptoasset Regulatory Framework expected to take effect in 2025. Global policies — particularly those from the US and EU — also affect sentiment and liquidity flows in GBP-denominated markets.

- Adoption Rates: Growing integration of Ethereum into mainstream finance, such as institutional staking services and decentralised finance (DeFi) platforms, has driven steady demand. Broader usage in tokenisation, NFTs, and real-world asset protocols continues to anchor long-term investor interest.

- Market Liquidity: Ethereum’s price reacts strongly to changes in trading volume and liquidity on major exchanges. In times of reduced liquidity, spreads widen and volatility intensifies, amplifying short-term price swings.

Regulatory and Institutional Outlook

The UK is positioning itself as a regulated crypto-finance hub. By 2025, cryptoassets such as Ethereum will likely fall under updated financial instruments legislation, creating clearer guidelines for exchanges and custody providers. At the same time, major asset managers are exploring Ethereum-based exchange-traded notes (ETNs) and institutional staking vehicles, signalling a gradual shift toward regulated Ethereum exposure.

Institutional involvement — through ETPs and custody platforms — increases market depth and price stability, helping to legitimise Ethereum as an investable digital asset within the UK financial system.

Staking Growth and Network Health

Since the Shanghai upgrade enabled staking withdrawals, Ethereum’s staking participation rate has risen above 20% of total supply, reinforcing its deflationary model and network security. Staking yields fluctuate around 3%–5% annually, offering investors a yield-bearing alternative to holding ETH passively.

However, higher staking demand can temporarily tighten circulating supply, influencing short-term price dynamics. UK investors can access staking through compliant platforms such as eToro, Bitpanda, or Coinbase, though returns may be lower than direct on-chain participation due to custodial fees.

Institutional and ETF Integration

Across Europe, Ethereum ETNs and ETPs listed on exchanges such as Deutsche Börse and Euronext have attracted substantial inflows. While the UK has not yet approved crypto ETFs, regulatory discussions point toward eventual adoption of similar products under FCA oversight. Once permitted, these vehicles could allow investors to gain Ethereum exposure through traditional brokerage accounts, potentially unlocking a new wave of demand from retail and pension funds.

Volatility and 2025 Market Outlook

Ethereum remains a high-volatility asset, influenced by macroeconomic factors such as interest rate changes, inflation data, and global liquidity cycles. However, the network’s transition to PoS, ongoing scalability enhancements, and growing institutional adoption have gradually reduced long-term downside risk.

Analysts expect Ethereum to maintain strong correlation with major indices and Bitcoin through 2025, though increased staking and Layer-2 adoption may soften volatility relative to prior cycles.

Investor Tip

If you plan to invest in Ethereum long-term, consider setting price alerts or using a dollar-cost averaging (DCA) strategy. DCA means investing a fixed amount of GBP at regular intervals regardless of ETH’s price. This approach smooths volatility exposure and removes emotional timing decisions.

Ethereum Price Predictions: 2025 and Beyond

Where might Ethereum’s price in the UK stand in 2025? Price predictions are speculative, but if Ethereum adoption continues at the current pace, some analysts anticipate a sustained upward trend.

That said, unforeseen factors like global economic shifts, regulatory changes, or major network issues can significantly alter price trajectories.

Pro Tip: Never invest more than you can afford to lose. Diversify your holdings to include various asset classes (stocks, bonds, precious metals, etc.) to spread risk effectively.

Comparing Ethereum Exchanges in the UK

How to choose the right exchange to buy Ethereum in the UK? Not all platforms are created equal.

Below is a quick comparison table we put together, unique to this article:

| Exchange | Trading Fees | Deposit Methods | Notable Feature |

|---|---|---|---|

| eToro | 1% (spread) | Bank Transfer, Card | Social Trading & CopyTrading |

| Bitpanda | 0.99% – 2.49% premium | Bank transfer, credit/debit card, PayPal, Apple Pay | Staking & Automatic Investing |

| Coinbase | 0.5% – 1.5% | Bank Transfer, Card | Simple Interface for Beginners |

| Uphold | ~0.9% (spread varies) | Bank Transfer, Card | Multi-Asset Offering (Stocks) |

Pro Tip: Always compare withdrawal fees. Some exchanges offer cheap trading fees but high withdrawal charges, which can eat into your profits when you cash out!

eToro is trusted by over 30 million users worldwide. It's the best place to buy Ethereum in the UK due to its cold storage, innovative trading features, user-friendly GBP deposit options, and industry-leading fees.

Buying Ethereum vs Other Cryptocurrencies

Should you only buy Ethereum? While Ethereum is a major player, the crypto universe extends far beyond it.

You might also explore:

- Bitcoin: The first and largest cryptocurrency. If you’re curious, see our guide on how to invest in Bitcoin in the UK.

- Altcoins (Cardano, Solana, Polkadot, and others): Emerging tokens with unique features and potential use cases—though they can be higher risk. Some focus on scalability or sustainable networks, which might give them a competitive edge in the long run.

- Meme Coins: Such as Dogecoin. If you fancy a more speculative play, check out how to buy Dogecoin.

- Stablecoins (USDT, USDC, DAI): Cryptocurrencies pegged to fiat currencies like the US dollar, designed to minimise volatility. They can be useful for quick trades or as a temporary store of value.

Balancing your crypto portfolio can help mitigate risk. Always do your own research and remember that crypto markets are volatile.

From my personal standpoint, I initially allocated 70% to Ethereum and 30% to smaller altcoins. Over time, I rebalanced based on performance and market trends, which helped me manage risks better (Not financial advice).

Invest in Ethereum with Different Methods

How to invest in Ethereum effectively? If you’re not just looking for a quick trade, consider these methods:

- Spot Buying. Purchase ETH directly in exchange and hold it in your wallet. This is the simplest way to gain exposure to Ethereum’s price movements.

- Ethereum-Focused ETFs or ETPs. Some UK platforms offer cryptocurrency ETPs (Exchange Traded Products) that track ETH. These are regulated financial instruments, making it easier for those who prefer traditional brokerage accounts.

- Staking. With Ethereum’s Proof of Stake model, you can stake your ETH to earn rewards. Staking offers a passive income but also locks up your coins for a certain period.

- CFDs or Spread Betting. Certain regulated brokers let you speculate on ETH’s price using Contracts for Difference (CFDs) or spread betting. While potentially profitable, these methods are risky due to leverage.

If you’re still not sure which approach suits you, you can also check out the best crypto apps for quick and user-friendly investing options.

Is Ethereum a good investment?

Is Ethereum a good investment? Ethereum’s potential stems from its real-world applications, ongoing upgrades, and broad community support.

Major corporations, including banks, are exploring Ethereum-based solutions for streamlining transactions and creating decentralised services. However, ‘good investment’ is always subjective.

Here are some points to consider:

- Pros: Large developer community, diverse use cases, ongoing upgrades.

- Cons: Network congestion can lead to high gas fees, competition from newer blockchains, regulatory uncertainties.

Ultimately, whether Ethereum is a good investment for you depends on your financial goals and risk tolerance. Always consult reputable financial advisors or do thorough research.

Fees, Taxes, and Regulations in the UK

How to buy Ethereum in the UK? Understanding fees, taxes, and regulations is essential.

- Trading Fees: Each exchange sets its own trading, deposit, and withdrawal fees. Always check the fee schedule before committing.

- Taxes: HM Revenue & Customs (HMRC) treats crypto as an asset. Gains above the annual tax-free allowance could be subject to Capital Gains Tax (source). If you’re unsure, consult a tax professional.

- FCA Regulations: Always use FCA-regulated platforms like eToro, Coinbase, or Uphold. This provides a layer of consumer protection, ensuring that you can trade and store crypto assets legally and safely.

Regulatory Overview

In the UK, cryptocurrency activity — including Ethereum trading, staking, and investing — is overseen by the Financial Conduct Authority (FCA). While the FCA does not regulate cryptocurrencies themselves as financial instruments, it supervises the business conduct of crypto exchanges and custodians, enforcing anti-money-laundering (AML) and Know Your Customer (KYC) standards.

All legitimate crypto platforms operating in the UK must appear on the FCA’s Cryptoasset Register, confirming compliance with domestic financial and security laws. Exchanges that are not FCA-registered cannot legally solicit UK clients. Investors should always verify authorisation status on the FCA’s public register before depositing funds.

The UK government is advancing the Cryptoasset Regulatory Framework, expected to be finalised in 2025, which will classify certain digital assets (including Ethereum) under broader financial-services law. This will extend investor protection, improve transparency, and integrate crypto oversight into existing markets legislation.

HMRC and Capital Gains Tax (CGT)

Ethereum transactions are treated as capital disposals by HM Revenue & Customs (HMRC). Any sale, exchange, or conversion of ETH into another crypto or fiat currency triggers a Capital Gains Tax (CGT) event.

- Tax-free allowance (2025): The annual CGT allowance is £3,000, meaning only profits above that amount are taxable.

- CGT rates:

- 10% for basic-rate taxpayers.

- 20% for higher- and additional-rate taxpayers.

- Cost basis: The allowable cost includes the original purchase price, transaction fees, and exchange charges.

- Losses: Capital losses from Ethereum trading can be used to offset other capital gains within the same tax year or carried forward.

HMRC requires all crypto investors to maintain detailed records of every transaction, including:

- Dates of purchase and disposal.

- GBP value at each point.

- Associated wallet addresses.

- Platform names and transaction IDs.

Failure to declare reportable gains can result in penalties or interest on unpaid tax.

Staking and Income Tax

Ethereum staking rewards are generally classified as miscellaneous income rather than capital gains.

- HMRC considers staking returns taxable when they are received or credited to the investor’s account.

- The applicable tax rate depends on your income band (20%, 40%, or 45%).

- When staked ETH is later sold, CGT may apply again on any capital appreciation since the initial staking date.

Investors using third-party staking providers should ensure that reward documentation and annual statements are retained for tax reporting.

ISA and ETN Status

At present, direct cryptocurrency holdings such as Ethereum cannot be placed inside an Individual Savings Account (ISA) or Self-Invested Personal Pension (SIPP).

However, the situation may evolve as regulated Exchange-Traded Notes (ETNs) or Exchange-Traded Products (ETPs) referencing Ethereum gain wider approval in Europe and potentially the UK.

If FCA-approved crypto ETNs or ETFs are introduced in the UK, they may become eligible for inclusion within ISAs or pension wrappers, offering investors exposure to Ethereum’s price movement while retaining tax advantages on gains.

Compliance Summary

- Use only FCA-registered exchanges and custodians.

- Track all capital disposals and staking rewards.

- Report taxable events annually via Self Assessment.

- Do not assume crypto gains are anonymous or exempt — HMRC actively collaborates with exchanges to identify undeclared transactions.

- Consider seeking professional tax advice if you engage in frequent or high-value Ethereum transactions.

Secure Storage Methods

The process doesn’t end after you hit the ‘buy’ button. Storage is crucial:

- Hot Wallets. Often come as mobile or web apps. They’re convenient for frequent transactions but are more vulnerable to hacks.

- Cold Wallets. Hardware wallets or offline storage devices that keep your private keys in a physical location, away from the internet.

- Paper Wallets. You can print your private keys and store them in a secure location (like a safe). This is less common nowadays but still an option for long-term “hodlers.”

If you plan to hold significant amounts of ETH, consider a reputable hardware wallet for peace of mind. For more on storage, see our best crypto wallets article.

What Are the Risks of Trading Ethereum

- Price Volatility: Ethereum’s price can fluctuate sharply within short periods, leading to rapid gains or losses.

- Regulatory Uncertainty: The UK’s Financial Conduct Authority (FCA) monitors crypto activities but does not insure crypto holdings under the Financial Services Compensation Scheme (FSCS).

- Cybersecurity Risks: Exchanges and hot wallets are frequent targets for hacks.

- Liquidity Issues: Smaller trading pairs may experience slippage or price gaps.

Smart Contract Bugs: Coding vulnerabilities in decentralised apps can lead to losses even when the Ethereum blockchain itself remains secure.

Alternatives to Buying Ethereum Directly

How to buy Ethereum in the UK if you don’t want to deal with exchange accounts? You can explore:

- Peer-to-Peer Platforms. P2P platforms let you trade directly with other sellers. You often have more payment options (PayPal, etc.), but do ensure you use escrow services for safety.

- Crypto Funds. Some investment trusts or funds hold a basket of crypto assets, including Ethereum. These can provide instant diversification.

- Coinbase Alternatives. If you’re looking to try something beyond the most popular platform, check out our best Coinbase alternatives for a UK-focused perspective.

I once used a P2P exchange to buy a small portion of Ethereum. It was an interesting experience, but I felt more comfortable using a well-known, regulated platform for larger amounts.

Balancing Your Crypto Portfolio

Looking to broaden your crypto holdings without putting all your eggs in one basket? Diversification is the key:

- Spread Across Multiple Exchanges. If you hold a large amount of crypto, splitting it among different platforms reduces the risk of a single point of failure.

- Consider Other Assets. Stocks, bonds, and commodities can cushion you from crypto’s volatility.

- Rebalance Periodically. Regularly review and adjust your holdings. Crypto markets move rapidly, so your initial 50-50 distribution between Bitcoin and Ethereum, for example, might shift to 30-70 within months.

Where to Next?

Still wondering how to proceed?

If you’ve grasped the basics of setting up an account and executing your first trade, your next steps should be:

- Explore more advanced trading features like limit orders and stop-loss orders to protect yourself from market dips.

- Look into the best crypto exchange for comprehensive reviews and fee comparisons.

- If you want to expand your portfolio, you can also see the best crypto to invest in for more coin suggestions.

Conclusion

Deciding to buy Ethereum in the UK is a question on many investors’ minds, and the good news is, it’s easier than ever before.

By choosing a platform registered with the FCA (such as eToro, Bitpanda, Coinbase, or Uphold), completing your KYC, and transferring funds, you’re only a few steps away from owning Ethereum.

Remember to secure your ETH in a reputable wallet, stay informed about taxes and regulations, and always consider the broader crypto market when making investment decisions.

Whether you’re a seasoned trader or a complete novice, Ethereum offers a unique opportunity to participate in the future of decentralised technology – all from the comfort of your home in the UK.

FAQs

Can I use the same platform to buy Ethereum and Bitcoin?

Yes, many FCA-regulated exchanges that support Ethereum also support Bitcoin and other cryptos. Centralising your trades in one place can simplify your experience, but be sure to check the platform’s fee structure and trading pairs before committing.

How long does it take to buy Ethereum?

Buying Ethereum typically takes a few minutes once your account is verified on a crypto exchange. Account verification (KYC) can take from a few minutes to a couple of days, depending on the platform. After verification, purchases are processed almost instantly.

Do I need a wallet to store Ethereum?

Yes, you need a wallet to store Ethereum. You can use a crypto exchange wallet for convenience or transfer it to a secure external wallet, such as a hardware or software wallet, for better security.

What is the best way to buy Ethereum?

The best way to buy Ethereum is through a reputable cryptocurrency exchange like Coinbase, eToro, or Kraken. Create an account, complete identity verification (KYC), link a payment method, and purchase Ethereum securely.

What is the cheapest way to buy Ethereum UK?

The cheapest way to buy Ethereum in the UK is through exchanges with low fees, like eToro or Kraken. Use bank transfers instead of debit or credit cards to minimise transaction costs. Always compare trading fees and withdrawal charges before purchasing.

What is the easiest way to buy ETH in the UK?

The easiest way to buy ETH in the UK is through user-friendly platforms like Coinbase or Revolut. Simply create an account, verify your identity, link a payment method, and purchase ETH with a few clicks.