Day trading in the UK involves buying and selling financial assets like stocks, forex, or CFDs within a single trading day.

The goal is to profit from short-term price movements rather than long-term growth. UK traders can access global markets through FCA-regulated brokers using platforms such as eToro, IG, or XTB.

To start day trading, you need to open a trading account, fund it, and develop a clear strategy supported by risk management tools like stop-loss orders. It’s vital to understand leverage and market volatility before trading with real capital.

What is day trading?

Day trading is the practice of buying and selling financial assets, such as stocks, forex, or CFDs, within the same trading day. The aim is to profit from short-term price movements rather than long-term investments.

Trades are often held for minutes or hours, closing before market close to avoid overnight risk. Successful day traders rely on technical analysis, fast execution, and strict risk management. This strategy requires discipline, as even small market swings can lead to losses.

How to start day trading in the UK

Follow these steps to begin day trading safely and effectively:

- Choose an FCA-regulated broker: Select a trusted, UK-licensed day trading platform such as eToro, IG, or XTB. Regulation by the Financial Conduct Authority (FCA) ensures client fund protection and transparent pricing.

- Open and verify your account: Complete identity verification (KYC) by uploading proof of ID and address. Most brokers allow quick online registration with no minimum deposit.

- Fund your account: Deposit money via Visa, bank transfer, or PayPal in GBP to avoid conversion fees. Start small until you understand market risks.

- Use a demo account first: Practise with virtual funds to test strategies and get familiar with trading tools without risking real capital.

- Choose your market: Focus on one or two assets like stocks, forex pairs, or indices. Specialising helps improve decision-making and risk control.

- Create a trading plan: Set clear rules for entry, exit, and stop-loss orders. Define your daily loss limit to avoid emotional decisions.

- Learn technical analysis: Use price charts, indicators, and volume data to identify short-term trading opportunities.

- Apply risk management: Risk only 1–2% of your capital per trade and avoid using excessive leverage.

- Track performance and improve: Review each trade, note mistakes, and refine your strategy over time.

What are the best markets for day trading in the UK?

The best markets for day trading in the UK are those with high liquidity, tight spreads, and strong price movement. These include:

- Forex (Foreign Exchange): The world’s largest and most liquid market, ideal for short-term trading. Major pairs like GBP/USD, EUR/USD, and USD/JPY offer tight spreads and 24-hour access.

- Stocks and Shares: UK and US equities, such as FTSE 100 and NASDAQ-listed companies, are popular due to volatility during market hours. Traders often target earnings reports or news events for quick opportunities.

- Indices (Stock Market Benchmarks): Instruments like the FTSE 100, DAX 40, and S&P 500 move consistently with economic data and are less affected by single-company risks.

- Commodities: Gold, oil, and natural gas are popular among active traders because they react sharply to geopolitical and economic changes. These are the best commodities to trade.

- Cryptocurrency CFDs: High volatility makes Bitcoin and Ethereum CFDs attractive, but they carry higher risk. Always use FCA-regulated CFD brokers since direct crypto trading remains unregulated in the UK.

Best day trading strategies

The best day trading strategies help you profit from short-term price movements while limiting losses.

Successful traders rely on a structured plan, technical indicators, and strong risk management.

Here are the most common and effective strategies used by UK day traders.

Scalping

Scalping involves opening and closing trades within seconds or minutes to capture small price movements. It works best in liquid markets such as major forex pairs, index CFDs, and large-cap stocks. Scalpers use tools like Level II order books, VWAP, and EMA indicators to identify quick entries and exits.

The goal is to make many small, consistent gains rather than a few large wins. Because profits per trade are small, tight spreads and low commissions are crucial. It requires intense focus and quick execution, and risk per trade should stay below 0.5% of total capital.

Momentum trading

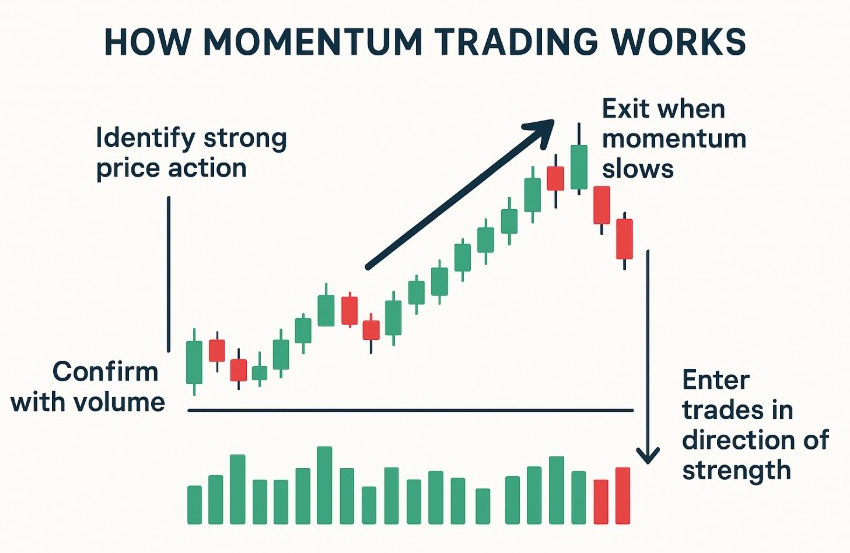

Momentum traders profit from strong directional moves driven by volume, volatility, or news events. The strategy works well in active markets like US equities, crypto CFDs, and major indices.

Traders typically enter after identifying high-volume breakouts and use indicators such as VWAP and RSI to confirm strength. The key is to “ride the wave” while momentum holds and exit before it fades. This approach suits traders who can act fast and manage emotional discipline during sudden reversals.

Breakout trading

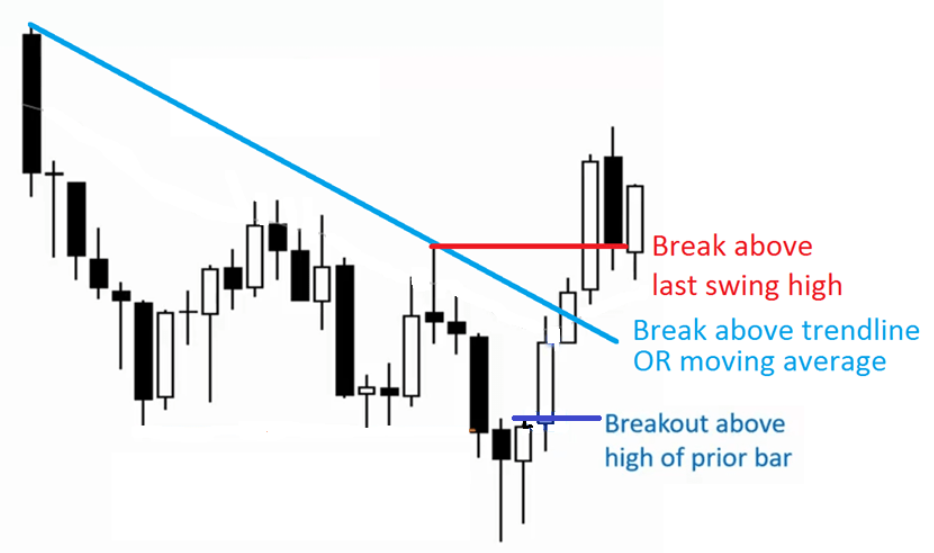

Breakout trading focuses on identifying key support and resistance zones and entering when price breaks beyond them. It’s commonly used in markets like the FTSE 100, DAX 40, and S&P 500.

Traders wait for confirmation through higher volume or candle closes outside the range before entering. The aim is to catch new trends as volatility expands, targeting measured moves based on the range’s height. False breakouts can be common, so using tight stop-losses just inside the breakout level is essential.

Reversal (mean reversion)

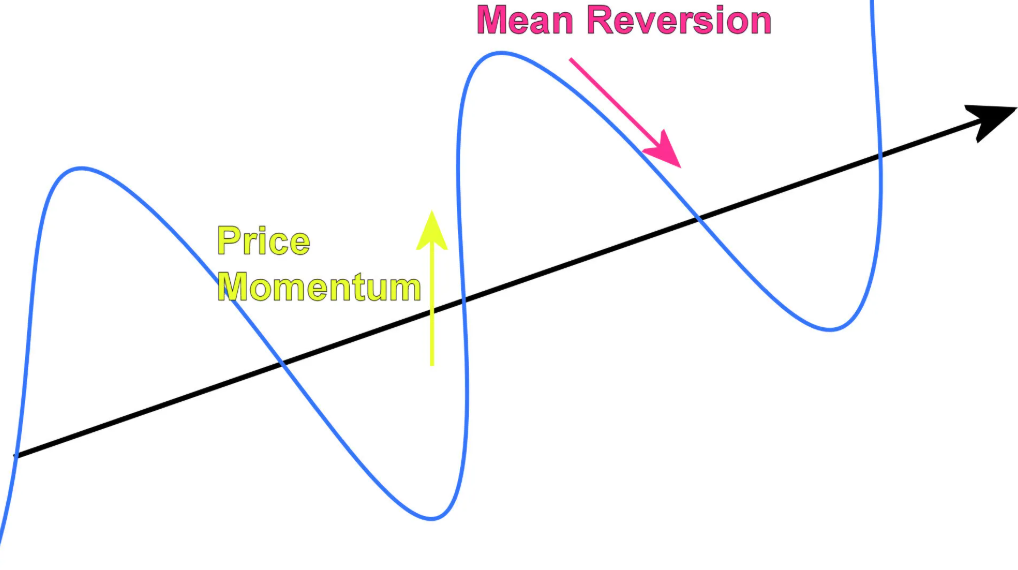

Reversal trading seeks to profit from overextended price moves returning to their average. It’s used in range-bound conditions or after sharp spikes in FX and indices. Traders look for signals like RSI divergence, Bollinger Band extremes, or reversal candlestick patterns.

The trade is closed as price reverts to VWAP or a central moving average. While this method offers frequent setups, it can be risky during trending markets, so strict stop-loss discipline is vital.

News-based trading

This strategy involves trading around scheduled economic data releases or corporate announcements that cause sharp price swings. Examples include Bank of England rate decisions, US Non-Farm Payrolls, or company earnings.

Traders prepare using economic calendars and OCO (one-cancels-other) orders. Because spreads and volatility spike, many wait a minute or two after release before entering. This approach can yield big moves in short periods but comes with risks like slippage and widened spreads.

Trend following

Trend following means trading in the same direction as a well-defined intraday trend. Traders use tools like moving averages (EMA 20/50) and ADX to confirm trend strength.

Entries occur on pullbacks with continuation signals, while exits use trailing stops or ATR-based systems. The goal is to capture large portions of sustained moves rather than short bursts. This strategy works best in active sessions and avoids the noise of sideways markets.

Algorithmic or automated trading

Algorithmic trading uses pre-programmed rules to execute trades automatically based on technical signals or statistical models. It’s popular in high-liquidity markets such as forex and indices.

Traders backtest systems extensively before deploying them live, using VPS hosting and strict drawdown limits. The advantage is emotion-free, consistent execution, but poor optimisation or regime shifts can quickly erode performance. Constant monitoring and periodic system reviews are essential.

Building your trading plan

Start by choosing one strategy and one market to master before expanding. Define your risk per trade (1–2% max), track every trade in a journal, and practise on a demo account before going live.

Focus on risk management and emotional control over chasing profits.

What you need to know before you start day trading

Day trading can be rewarding but also one of the riskiest forms of investing. Before you start, it’s essential to understand the key requirements, costs, and risks involved.

1. Knowledge and education

Learn how financial markets work and how prices move in response to news, economic data, and investor sentiment. Study technical analysis, chart patterns, and indicators like moving averages and RSI. Most FCA-regulated brokers offer free demo accounts, webinars, and educational resources that help you build confidence before risking real money.

2. Regulation and broker safety

Only use FCA-regulated brokers that segregate client funds and provide transparent pricing. This ensures your money is protected under FSCS up to £85,000 if the broker becomes insolvent. Avoid offshore platforms that lack UK regulatory oversight.

3. Risk and leverage

Day trading often involves CFDs, which use leverage to magnify both profits and losses. In the UK, retail traders are limited to 30:1 leverage on major forex pairs under FCA rules. Always use stop-loss orders and risk no more than 1–2% of your capital per trade to prevent large drawdowns.

4. Costs and fees

Frequent trading means higher transaction costs. Pay attention to spreads, commissions, and overnight financing (swap) fees. Even small differences can affect long-term profitability. Choose brokers offering low spreads and fast execution.

5. Tools and setup

You’ll need a reliable trading platform, stable internet connection, and a workspace free from distractions. Most day traders use charting tools like MetaTrader 4, TradingView, or proprietary broker platforms. Consider dual screens and fast data feeds for monitoring multiple markets.

6. Trading psychology

Emotional discipline is critical. Fear and greed can lead to impulsive trades or early exits. Develop a written trading plan that defines your entry, exit, and risk rules. Keep a journal to track mistakes and improve decision-making over time.

7. Taxes and legal obligations

In the UK, spread betting profits are tax-free, but CFD and share trading gains may fall under Capital Gains Tax (CGT). Keep accurate records for HMRC reporting. You must also be 18 or older to open a live trading account.

8. Realistic expectations

Day trading is not a get-rich-quick method. It requires time, discipline, and experience. Most beginners lose money early due to overtrading or poor risk management. Focus on learning, consistency, and capital preservation above profit.

FAQs

How much money should a beginner day trader start with?

A beginner day trader should start with an amount they can afford to lose, typically ranging from £500 to £1,000 for adequate diversification and risk management. However, some brokers offer accounts with low minimum deposits, sometimes as low as £100, suitable for practicing trading strategies. It’s crucial to consider trading costs and the need for effective risk management when determining your starting capital.

Is day trading good for beginners?

Day trading is not generally recommended for beginners due to its high-risk nature and the quick decision-making it requires. It involves a significant time commitment and a steep learning curve, and there’s a high likelihood of incurring losses, especially for those who are new to trading. Beginners are often advised to start with longer-term investment strategies and to practice with demo accounts before diving into day trading.

Why do you need 25k to start day trading?

The $25,000 requirement is specific to the United States and is known as the Pattern Day Trader (PDT) rule, enforced by the Financial Industry Regulatory Authority (FINRA). The rule states that anyone who executes four or more day trades within five business days must maintain a minimum equity balance of $25,000 in their brokerage account. The rule aims to protect inexperienced traders from the high risks associated with day trading.

What do I need to start day trading?

To start day trading, you need an FCA-regulated broker account, initial trading capital (typically £500–£1,000+), and a reliable trading platform like eToro, IG, or XTB. You’ll also need fast internet, a demo account for practice, and a clear trading plan with risk limits and stop-loss rules. Understanding technical analysis, leverage, and tax obligations is essential before trading live.

Can I make money day trading?

Yes, it’s possible to make money day trading, but it’s high-risk and very challenging. Most beginners lose money due to poor risk management and lack of discipline. Profitable traders usually have tested strategies, strict stop-loss rules, and years of experience. Returns are never guaranteed, and results vary by market conditions and skill.

What is the 2% rule in day trading?

The 2% rule in day trading means you should never risk more than 2% of your total account balance on a single trade. For example, if your account holds £5,000, your maximum loss per trade should be £100. This rule helps protect capital and manage drawdowns during losing streaks, allowing traders to stay consistent over time.

Is day trading gambling or skill?

Day trading is based on skill, discipline, and strategy, not luck, but it can resemble gambling if done without a plan. Successful traders use technical analysis, risk management, and data-driven decisions to gain an edge. Those who trade impulsively or without a clear system often rely on chance. In short, it’s a skill when managed like a business, but gambling when driven by emotion.

Can beginners make money day trading?

Beginners can make money day trading, but it’s rare without proper preparation. Most new traders lose money early due to inexperience, overtrading, or poor risk control. Starting with a demo account, learning technical analysis, and developing a clear trading plan are essential first steps. Consistency and discipline matter more than quick profits.