Trading 212 has become one of the UK’s most popular investing apps, with over 1.5 million users and an impressive 4.6/5 average rating. But popularity alone doesn’t guarantee reliability.

This review takes a closer look at whether Trading 212 is a safe, FCA-regulated platform, and how it performs across key areas like fees, usability, and customer support.

You’ll find a feature-by-feature breakdown, scored using Sterling Savvy’s independent testing framework, which converts qualitative points into star ratings. The goal is to help you decide if Trading 212 suits your investment style and risk appetite.

For more information on how we test view here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

How good is Trading 212 overall?

Overall rating: 4 stars (67.4 points / 74.8%)

Trading 212 is an excellent choice for beginners or casual investors who want to buy stocks and ETFs with low fees and a user-friendly app. It’s FCA-regulated and offers both Invest and ISA accounts, making it easy to start investing securely.

However, it lacks some key features for advanced traders. You won’t find cryptocurrency, bonds, or commodities, and the research tools are quite limited compared to brokers like IG or XTB.

Pros

- Great for beginner investors

- Low fees

- Excellent mobile app

- Free practice account available

- ISA options offered

Cons

- No crypto, bonds, or commodities

- Limited research and education tools

- Not available in the US or Canada

Trading 212 category breakdown

| Category | Points | Star rating |

|---|---|---|

| Fees | 9.2 | ⭐⭐⭐⭐⭐ |

| Safety | 9.5 | ⭐⭐⭐⭐⭐ |

| Onboarding | 8.9 | ⭐⭐⭐⭐½ |

| Deposit & withdrawal methods | 9.0 | ⭐⭐⭐⭐½ |

| Markets | 8.3 | ⭐⭐⭐⭐½ |

| Tools | 7.0 | ⭐⭐⭐½ |

| Platform usability | 8.5 | ⭐⭐⭐⭐½ |

| Education | 7.0 | ⭐⭐⭐½ |

| Customer service | 9.5 | ⭐⭐⭐⭐⭐ |

Verdict: Trading 212 is best suited for beginner and intermediate investors who want a low-cost, FCA-regulated platform for simple stock and ETF investing.

What are the fees on Trading 212?

Overall rating: 5 stars

Trading 212 offers one of the simplest and lowest-cost fee structures of any FCA-regulated UK stock broker.

You can buy and sell stocks and ETFs commission-free, with no withdrawal or inactivity fees, making it ideal for long-term investors who prefer a low-maintenance approach.

Unlike many competitors, Trading 212 won’t charge you for leaving your account inactive. For comparison:

- IG applies an inactivity fee after two years (£13.77/month)

- eToro starts after one year (£7.65/month)

- Plus500 activates it after three months (£10/month)

This means you can invest at your own pace without worrying about surprise charges.

However, a small 0.15% currency conversion fee applies if you buy assets priced in a different currency, and CFD or forex trades also carry this same rate. That’s still lower than many rivals such as eToro, which charges up to 0.5%.

You can further reduce conversion costs by holding multiple currencies within your account or trading in the same base currency.

Pros

- Commission-free stock and ETF trading

- No withdrawal or inactivity fees

- Simple and transparent pricing

Cons

- CFD and FX conversion fees apply (0.15%)

Verdict: Trading 212’s fee model is straightforward, transparent, and perfect for cost-conscious investors.

Is Trading 212 safe and trustworthy?

Overall rating: 5 stars

Yes, Trading 212 is a very safe and regulated investment platform for UK users. It is authorised and supervised by the Financial Conduct Authority (FCA), ensuring that client funds are held securely and the company follows strict financial conduct standards.

The platform also provides negative balance protection, meaning you can never lose more than your deposited funds, even in highly volatile markets. This safeguard is standard among top-tier brokers like eToro, IG, and Plus500.

Trading 212 has also demonstrated long-term stability. Founded in 2004, it successfully operated through the 2008 financial crisis and has maintained a strong reputation ever since. Its London office opened in 2013, serving as its main base of operations.

While Trading 212 does not hold a banking licence and its financial data is not publicly available, these factors are not uncommon for brokers and do not raise significant concerns given its FCA oversight.

Pros

- Regulated by the FCA

- Negative balance protection included

- Nearly 20 years of stable operation

Cons

- No banking licence

- Financial statements not publicly disclosed

Verdict: Trading 212 is a safe, FCA-regulated broker offering strong investor protection and proven reliability.

How easy is it to open a Trading 212 account?

Overall rating: 4.5 stars

Opening an account with Trading 212 is quick, simple, and fully digital. The onboarding process is one of the smoothest among UK brokers, taking less than 24 hours for most users.

You can start by downloading the Trading 212 app and entering basic details such as your name, date of birth, and taxpayer ID. You’ll then need to upload a valid photo ID (passport or driving licence) and a selfie for verification. Once approved, you can choose from three account types:

- Invest Account – £1 minimum deposit

- CFD Account – £10 minimum deposit

- ISA Account (UK only) – £10 minimum deposit

Account approval times vary, but most UK users are verified within a day. In the past, onboarding delays were common, but the process has been significantly improved and is now fast and reliable.

Do note that Trading 212 is not available in every country, including the United States and Canada, so eligibility depends on your location.

Pros

- Fast and straightforward sign-up

- Low minimum deposits

- Fully online verification

Cons

- Some users experience ID verification delays

Verdict: Trading 212 offers a smooth, beginner-friendly onboarding experience with minimal deposits and quick verification.

What deposit and withdrawal methods does Trading 212 offer?

Overall rating: 4.5 stars

Trading 212 provides fast, secure, and fee-free deposits and withdrawals, making it one of the most convenient brokers for UK investors. Most payment methods are supported, and there are no hidden fees for standard transactions.

Deposits

Adding funds is straightforward. Simply go to the ‘Deposit’ tab, select your amount, and choose a payment option. Available methods include:

- Debit/credit card

- Bank transfer

- Google Pay / Apple Pay

- PayPal

Deposits are free up to £2,000 when using a card or e-wallet. Beyond this, a 0.7% fee applies. To avoid this, you can deposit via bank transfer, which remains completely free.

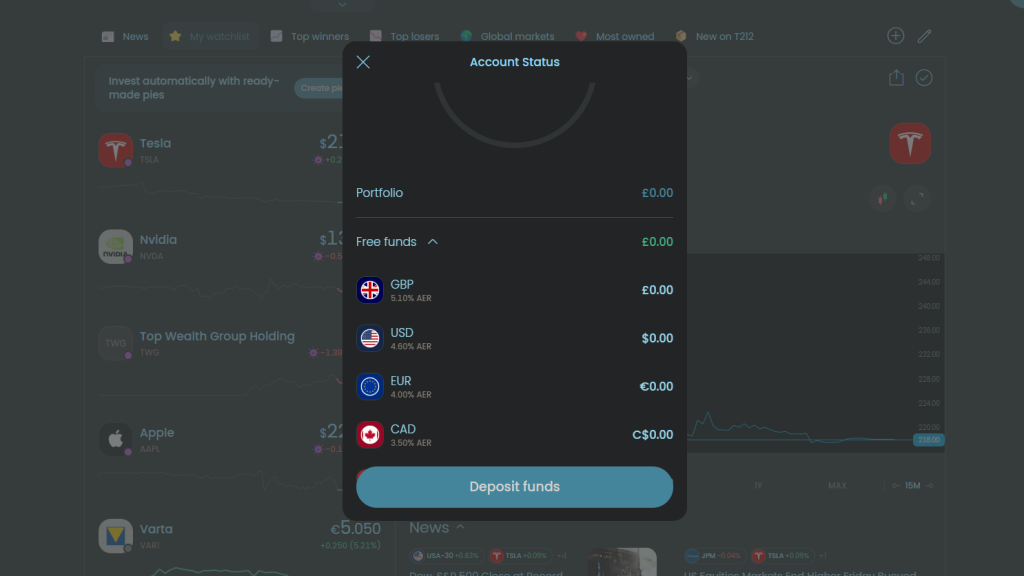

Trading 212 also supports multiple base currencies, allowing you to trade in foreign currencies without conversion fees, which is ideal for global investors.

Withdrawals

Withdrawals are free and simple to complete. You can manage your funds directly in the app by selecting the amount and confirming with your password.

In most cases, withdrawals are processed within one business day, though delays can occur depending on your bank.

Pros

- No deposit or withdrawal fees

- Wide range of payment methods

- Multiple base currencies available

Cons

- 0.7% fee on card/e-pay deposits over £2,000

- Withdrawals may take longer on occasion

Verdict: Trading 212 offers smooth and cost-effective deposits and withdrawals, ideal for UK investors who value speed and transparency.

What markets can you trade on Trading 212?

Overall rating: 4.5 stars

Trading 212 provides excellent access to core markets like stocks, ETFs, and CFDs, making it a strong all-round platform for most UK investors. However, it lacks cryptocurrency and bond investing, which limits diversification for more advanced traders.

Stocks and ETFs

Trading 212 stands out for its extensive range of over 9,000 real stocks across 15 global markets. You can also invest in ETFs and REITs (Real Estate Investment Trusts), giving exposure to different sectors, including real estate.

The platform supports fractional shares, allowing you to invest small amounts in high-value companies, making diversification easy and affordable.

If your main goal is to invest in stocks or ETFs, Trading 212 is one of the best UK options due to its variety, ease of use, and intuitive trading interface.

CFDs

For experienced traders, the CFD account offers access to:

- 179 forex pairs

- Commodities, indices, and treasury futures

- Over 1,500 stock CFDs and 28 ETF CFDs

That said, CFDs are high-risk instruments, and around 68% of retail traders lose money when using them. They’re best suited to advanced investors familiar with leveraged trading.

Cryptocurrency and bonds

Trading 212 does not offer crypto or bond trading, which may be disappointing if you want broader diversification. Competitors like eToro and IG provide crypto assets and bond ETFs, which could be better options for those markets.

Pros

- Excellent range of stocks and ETFs

- Strong CFD and forex offering

- Fractional shares available

Cons

- No cryptocurrency trading

- No bonds, SIPPs, or pension options

Verdict: Trading 212 excels for stock and ETF investors, but lacks crypto and bond markets that advanced users might seek.

What trading tools does Trading 212 offer?

Overall rating: 3.5 stars

Trading 212 includes a mix of useful investing tools and research features, but falls short compared to more advanced platforms. While it provides excellent custom portfolio options and solid charting tools, it lacks features such as market news or trading ideas that experienced investors may expect.

Pies

One of Trading 212’s standout tools is its ‘Pies’ feature. This lets you build a custom portfolio of stocks and ETFs, assigning specific weightings to each asset. You can invest in your entire pie with a single click, simplifying diversification and portfolio management.

There are also hundreds of public pies created by other users, which you can explore and copy. This makes the feature particularly attractive for beginners who want a starting point for building a balanced portfolio. However, it’s still important to review each pie carefully and understand what you’re investing in.

Research and charting tools

Trading 212 provides access to charting tools with 50 technical indicators, basic fundamental data, and an economic calendar for tracking major market events. These are sufficient for casual investors, but limited for advanced analysis.

Some users may find chart customisation restrictive, and the absence of trading suggestions or a live newsfeed limits real-time insight and strategy development.

Pros

- Innovative ‘Pies’ portfolio builder

- Access to fundamental data and charting tools

- Useful economic calendar

Cons

- No trading ideas or newsfeed

- Limited chart customisation

Verdict: Trading 212 offers smart portfolio management tools and basic research features, ideal for beginners but too limited for advanced traders.

How good is the Trading 212 platform and app?

Overall rating: 4.5 stars

Trading 212 delivers one of the best trading experiences among UK investment apps, combining a clean interface with fast execution and simple navigation. Both the web platform and mobile app are well designed, but the mobile app stands out for its usability and speed.

Platform experience

The web version is intuitive and visually appealing, with clear data displays and an efficient layout. However, the mobile app is the real highlight. It’s accessible even for beginners, with everything organised into simple menus and a powerful search bar that lets you find stocks or ETFs instantly.

Making a trade is straightforward. Deposits appear within seconds, and placing an order takes only a few taps. You can view live market data, past performance charts, and even set price alerts to track movements on your favourite stocks or ETFs.

Tools and quality-of-life features

The app includes over 50 charting tools, price alerts, and a demo account with £5,000 in virtual funds, allowing you to practise trading safely. You can also use a Filter function to find stocks by price or category, making portfolio management simple.

However, Trading 212 lacks copy trading, and it does not support MT4 or MT5, which limits options for forex or advanced technical traders. It’s also not ideal for day trading, as execution speed and liquidity aren’t optimised for high-frequency strategies.

Pros

- Excellent mobile trading app

- Free demo account with virtual funds

- Custom filters and price alerts

Cons

- No desktop trading platform

- No copy trading or MT4/MT5 integration

- Not suitable for day trading or active forex trading

Verdict: Trading 212 offers a near-flawless investing experience for long-term investors and beginners, but lacks the advanced tools that professional traders might need.

What education and learning resources does Trading 212 offer?

Overall rating: 3.5 stars

Trading 212 provides a solid range of educational content focused on helping beginners understand investing and personal finance. The resources are easy to access and cover the basics well, though they may feel limited for advanced traders.

The platform’s official YouTube channel features over 30 educational videos that explain key topics such as reading financial statements, diversifying portfolios, and understanding ETFs. Each video is clear, short, and practical, ideal for new investors learning the fundamentals.

If you prefer reading, the Trading 212 website also includes simple, beginner-friendly articles that break down complex financial concepts into plain English.

However, Trading 212 does not currently offer webinars or live training, which are features available on more advanced platforms like eToro. This means experienced investors may find the educational support somewhat limited.

Pros

- Beginner-focused learning materials

- Educational videos and written guides

- Easy to access through YouTube and the website

Cons

- Lacks advanced training and webinars

- Limited depth for professional traders

Verdict: Trading 212’s educational content is clear and practical for beginners, but advanced users may prefer brokers with in-depth training resources.

How good is Trading 212’s customer service?

Overall rating: 5 stars

Trading 212 provides excellent customer support, with fast response times and knowledgeable agents available 24/7. Out of all major UK investing platforms, its support team stands out for being both responsive and easy to reach.

You can contact Trading 212 through live chat or email support. The live chat feature is available around the clock, allowing you to get help within minutes no matter when an issue arises.

When submitting an email query, you’ll first receive helpful FAQ links that may resolve your question. If not, a team member typically replies within a few hours, offering clear and actionable solutions.

The support agents are professional and efficient, often resolving problems directly on their end so you don’t need to take further steps. The only drawback is the lack of phone support, though most users find live chat faster and more convenient.

Pros

- Easy access to live chat and email support

- Fast, relevant responses

- 24/7 availability

Cons

- No phone support

Verdict: Trading 212’s customer service is among the best in the UK market, offering reliable, round-the-clock assistance for all users.

Who is Trading 212 best suited for?

Trading 212 is best suited for beginner and intermediate investors who want a simple, low-cost way to invest in stocks and ETFs through an FCA-regulated platform.

Its commission-free structure, intuitive app, and demo trading account make it ideal for those learning how to invest or looking to build a long-term portfolio without complex tools.

It’s also a strong choice for casual investors who value convenience and transparency, as there are no inactivity or withdrawal fees and the mobile app is exceptionally user-friendly.

However, Trading 212 may not suit advanced or high-frequency traders, since it lacks cryptocurrency, bonds, MT4/MT5 integration, and copy trading options.

Best for:

- Beginners learning to invest

- Long-term, passive investors

- ISA account holders looking for tax-efficient investing

Not ideal for:

- Active forex or day traders

- Crypto investors

- Users needing advanced analytics or copy trading features

Final thoughts

Trading 212 is one of the most accessible and affordable investing platforms in the UK. It combines FCA regulation, commission-free trading, and an excellent mobile app to deliver a seamless experience for beginners and long-term investors.

While it lacks advanced tools and certain markets like crypto and bonds, its simplicity, safety, and low fees make it a top choice for everyday investors seeking a reliable, easy-to-use platform.

FAQs

Is Trading 212 safe in the UK?

Yes, Trading 212 is considered safe for UK users. It is regulated by the Financial Conduct Authority (FCA), which ensures that the platform operates in compliance with strict financial standards and provides an added layer of protection for investors. Trading 212’s FCA regulation helps to instill confidence in users regarding the security and reliability of the platform. However, as with any investment service, users should also exercise caution and conduct their research before making any financial decisions.

Is Trading 212 a good way to make money?

Trading 212 can be a viable platform for making money through stock trading and investing, offering a user-friendly interface and commission-free trades. However, success in making money depends on individual investment strategies, market knowledge, and risk management. Like all trading platforms, it carries risks, and profits are not guaranteed.

How popular is Trading 212 in the UK?

According to a study on Statista, in total, 13% of UK neo-banking and neo-brokerage users say they like Trading 212. However, in actuality, among the 39% of UK respondents who know Trading 212, 33% of people like the brand.