Automated trading platforms let UK traders use algorithms to execute trades automatically based on preset strategies.

The best options in 2025 combine AI-powered analytics, low fees, and FCA regulation for safety and transparency.

These tools help you remove emotion from trading, test strategies with demo accounts, and manage risk across markets such as forex, CFDs, and crypto.

All featured brokers are FCA-regulated and offer robust automation tools, from MetaTrader Expert Advisors (EAs) to API and copy-trading systems.

Quick answer: What are the best automated trading platforms UK?

The best automated trading platforms in the UK are eToro, XTB, and IG. eToro offers advanced social and copy trading automation, XTB provides intuitive tools and robust charting for strategy execution, and IG delivers professional-level automation through APIs and algorithmic integrations. All three are FCA-regulated, ensuring security and transparency.

5 best algorithmic trading platforms ranked

Here’s a quick list of the best automated trading platforms in the UK, selected through expert testing and performance analysis:

Your capital is at risk.

- eToro – Best for beginners

- XTB – Best for CFDs

- IG – Best for selection of over 19,500 instruments

- AvaTrade – Best low-cost platform

- CMC Markets – Best for using MetaTrader 4

Best automated trading apps compared for UK traders

This comparison ranks the platforms using five key criteria that every UK trader should evaluate before choosing an automated trading platform:

| Rank | Trading platform | Minimum deposit | S&P 500 CFD spread (average) | Commission | Platform fee | Types of assets |

|---|---|---|---|---|---|---|

| 1 | eToro | $50 | 0.8 | 0% | £0 | Stocks, indices, ETFs, currencies, commodities, crypto |

| 2 | XTB | £0 | 0.6 | 0% | £0 | Forex, indices, commodities, stocks, ETFs, CFDs |

| 3 | IG | £250 | 0.4 | Varies | £0 | Real stocks & ETFs, exchange-traded securities, CFDs (currency pairs, stock indices, stocks, ETFs, commodities, crypto, bonds, and futures) |

| 4 | AvaTrade | $0 | 0.6 | $0.02 per share | £0 | Stocks, indices, ETFs, currencies, commodities, crypto, bonds |

| 5 | CMC Markets | £100 | 0.5 | 0% | £0 | Forex, stocks, commodities, indices |

Auto trading software reviews

Around 42% of UK adults now invest or trade, up from 36% in 20211.

Choosing a trusted, FCA-regulated automated trading platform is key for anyone entering the market.

This guide ranks the best automated trading platforms in the UK based on five key factors: minimum deposit, S&P 500 CFD spread, commission, platform fee, and asset range.

Each platform was also assessed for safety, usability, research tools, and educational support.

All featured brokers are FCA-regulated, ensuring transparency and protection for UK traders.

You can read about how we test platforms here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

1. eToro – Best for beginners

eToro ranks as the best automated trading platform in the UK for beginners and hands-off traders.

The platform is FCA-regulated, user-friendly, and supports a wide range of markets, including stocks, forex, ETFs, indices, and commodities.

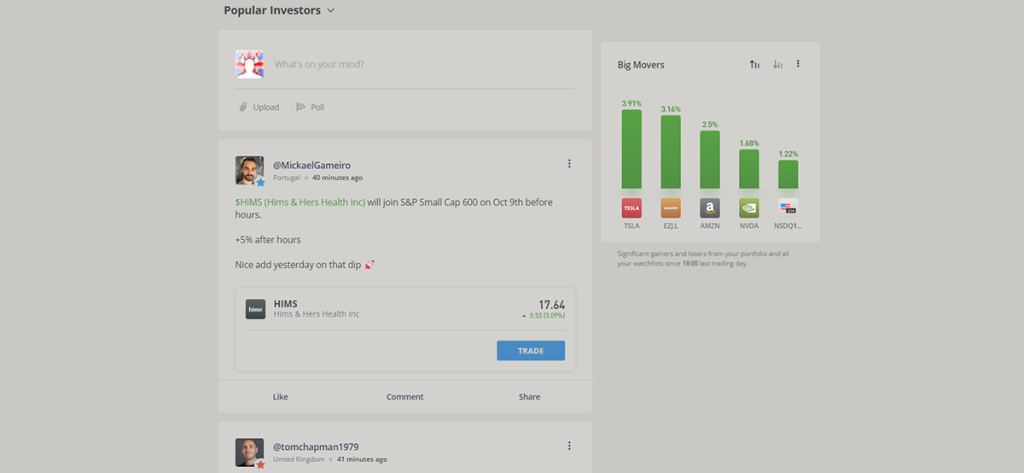

Its standout feature is CopyTrader, which lets you automatically mirror the trades of verified, experienced investors in real time.

This makes eToro ideal if you’re new to trading or prefer a passive strategy. You can view each trader’s performance, risk score, and portfolio before copying their moves.

The platform also includes a social trading feed, where users share insights and strategies, creating an interactive learning environment.

Combined with eToro Academy’s tutorials and demo accounts, it’s a complete solution for developing trading confidence.

With over 30 million users worldwide and an ‘Excellent’ Trustpilot rating (18,000+ reviews), eToro remains a trusted, low-cost choice for automated and social trading in 20252.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) | Commission | Platform fee | Types of assets |

| $50 | 0.8 | 0% | £0 | Stocks, indices, ETFs, currencies, commodities, crypto |

Read our eToro review.

Pros:

- Commission-free stock trading

- Extensive range of financial assets

- Intuitive automated trading interface

- Features like CopyTrader and social trading are available

- Regulated by top-tier authorities like FCA

Cons:

- Lacks technical analysis features

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. XTB – Best for CFDs

XTB is a publicly listed broker on the Warsaw Stock Exchange and is FCA-regulated in the UK.

It offers access to over 5,800 tradable assets, including stocks, ETFs, indices, commodities, and forex, through its proprietary xStation 5 platform, available on web, desktop, and mobile.

The platform supports automated trading via built-in strategy tools and algorithmic systems, allowing users to execute trades based on predefined parameters.

Its risk management dashboard gives real-time insights into portfolio exposure and performance, ideal for those running automated or high-frequency setups.

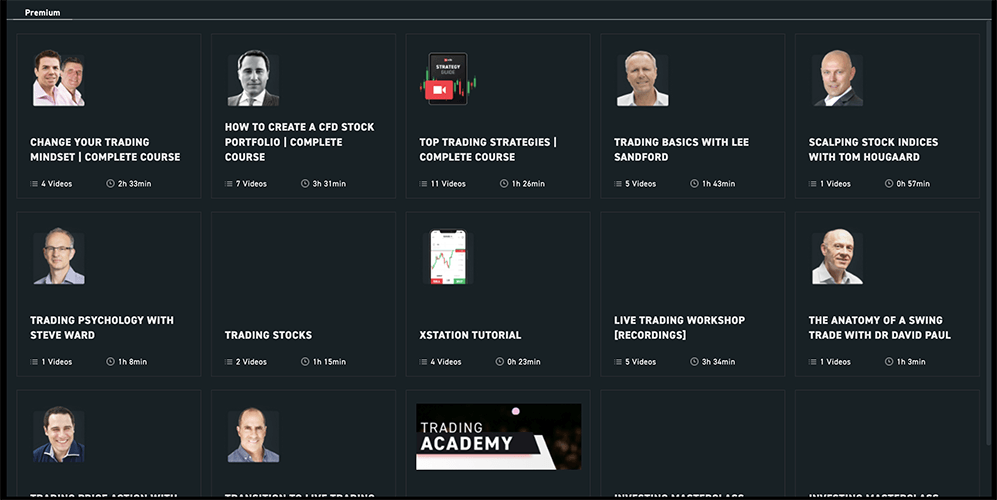

Traders benefit from comprehensive educational resources, including webinars, tutorials, and live market analysis, plus a demo account for strategy testing.

While XTB does not yet support fractional shares, it remains one of the most advanced and transparent CFD brokers in the UK, combining institutional-grade tools with a user-friendly interface.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) | Commission | Platform fee | Types of assets |

| £0 | 0.6 | 0% | £0 | Forex, indices, commodities, stocks, ETFs, CFDs |

Pros:

- Commission-free stocks and ETFs for investments up to 100k per month

- Free and quick deposit and withdrawal process

Cons:

- Primarily limited to CFDs

- Inactivity fees

73% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

3. IG – Best for selection of over 19,500 instruments

IG is a FTSE 250-listed, FCA-regulated broker offering one of the most complete trading ecosystems in the UK.

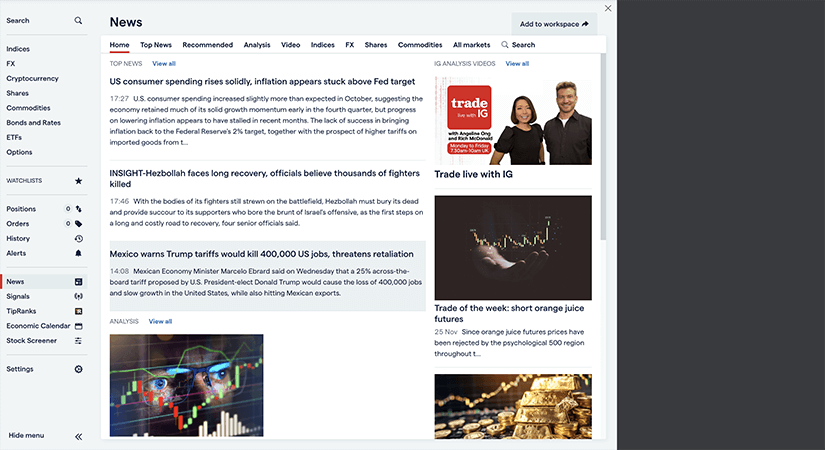

With access to over 19,500 instruments across forex, stocks, indices, and commodities, it stands out for its versatility and automation tools.

Traders can automate strategies in three main ways:

- IG API – enables developers to build custom trading systems, access live data, and manage portfolios programmatically.

- ProRealTime – intuitive, code-free automation with 100+ indicators and backtesting tools. Free for active traders (4+ trades per month).

- MetaTrader 4 (MT4) – supports custom indicators and Expert Advisors (EAs) for rule-based trade execution.

Spreads start from 0.1 pips, and inactivity fees apply only after two years.

IG’s mobile and desktop platforms feature 30+ technical indicators, 20 drawing tools, and extensive timeframes for professional-level charting.

Its research and education resources are among the best in the industry, with IG Academy courses, DailyFX analysis, Reuters news, and an active community of 60,000+ traders sharing insights and strategies.

IG is ideal for traders seeking deep market access, reliable automation tools, and professional-grade analysis in a trusted, FCA-regulated environment.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) | Commission | Platform fee | Types of assets |

| £250 | 0.4 | Varies | £0 | Real stocks & ETFs, exchange-traded securities, CFDs (currency pairs, stock indices, stocks, ETFs, commodities, crypto, bonds, and futures) |

Read our IG Markets review.

Pros:

- Access to more than 19,500 tradeable instruments

- Choice of three diverse trading platforms

- Comprehensive educational and research resources

- No charges for deposits and withdrawals

Cons:

- High stock CFD fees

- Higher initial deposit requirement

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

4. AvaTrade – Best low-cost platform

AvaTrade is a commission-free, FCA-regulated broker offering fast, user-friendly access to forex, CFDs, stocks, indices, commodities, and crypto.

It’s ideal for traders who want automation without high costs or complex setup.

The platform supports three leading auto-trading systems:

- Capitalise.ai – enables code-free strategy automation using plain language commands.

- DupliTrade – allows copy trading from verified professional traders.

- ZuluTrade – connects you to a global network of signal providers for social automation.

AvaTrade also includes advanced charting, risk management tools, and a demo account for testing strategies.

With tight spreads, 24/5 customer support, and a simple interface, it’s one of the best entry points for automated trading in 2025.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) | Commission | Platform fee | Types of assets |

| £100 | 0.5 | 0% | £0 | Forex, stocks, commodities, indices |

Pros:

- Hassle-free account setup

- Zero charges for deposits and withdrawals

- Outstanding research capabilities

Cons:

- Limited selection of available assets

5. CMC Markets – Best for using MetaTrader 4

CMC Markets is an FCA-regulated, FTSE 250-listed broker offering access to over 200 instruments across forex, indices, commodities, and shares.

It’s one of the top automated trading platforms in the UK, ideal for experienced traders who value flexibility and control.

The platform integrates seamlessly with MetaTrader 4 (MT4), allowing users to deploy Expert Advisors (EAs), custom indicators, and automated strategies.

Traders can also access CMC’s proprietary Next Generation platform, featuring 115+ technical indicators, 70 chart patterns, and robust risk management tools.

With competitive spreads, an award-winning mobile app, and high-quality research and education resources, CMC Markets delivers a complete, professional-grade trading experience backed by strong regulation and transparent pricing.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) | Commission | Platform fee | Types of assets |

| $0 | 0.6 | $0.02 per share | £0 | Stocks, indices, ETFs, currencies, commodities, crypto, bonds |

Pros:

- Extensive product selection

- Ideal for automated forex trading in the UK

- MetaTrader 4 enables complete trade automation

- Top-notch customer support and educational materials

- Zero minimum deposit requirement

- Competitive fees

Cons:

- Expensive spreads for CFDs

- Lacks back-testing

What is an automated trading system?

An automated trading system (ATS) is software that executes trades automatically based on predefined rules such as price, volume, or indicators. Once programmed, it analyses live market data and places trades without human input. In the UK, ATSs are widely used across forex, stock, CFD, and crypto markets to reduce emotion and improve execution speed.

These systems combine algorithms, execution engines, and risk controls to deliver consistent and disciplined trading results. Their key advantages are speed, precision, and objectivity, which manual trading cannot match.

Common automated trading strategies in the UK

- Copy trading: Platforms like eToro and AvaTrade (via DupliTrade and ZuluTrade) let users automatically mirror professional traders’ portfolios. This suits beginners who want passive exposure to experienced strategies.

- Semi-automated trading: Used by brokers such as XTB and IG, this model generates trade signals and partially automates execution while keeping user control over entries and exits.

- Expert Advisors (EAs): On MetaTrader 4 and 5, traders can create or import algorithmic bots that execute trades based on custom criteria. EAs can be backtested and run continuously on VPS servers for 24/7 trading.

How does automated trading work?

Automated systems typically follow four key stages:

- Define strategy – Set rules for entry, exit, and risk management.

- Generate signals – Monitor markets in real time using technical indicators.

- Execute orders – Automatically send trades to the broker’s platform via API.

- Monitor risk – Adjust stops or targets dynamically as volatility changes.

Before going live, traders often backtest strategies on historical data to assess performance and refine risk settings.

Pros and cons of automated trading platforms

Pros

- Removes emotional bias and promotes disciplined trading

- Executes orders with millisecond precision

- Enables 24/7 monitoring across multiple markets

- Supports diversification with multiple active strategies

- Allows backtesting for data-driven optimisation

- Compatible with VPS hosting for uninterrupted operation

Cons

- VPS and data feed fees add to running costs

- Over-optimised strategies may perform poorly in live markets

- System or internet failures can cause unexpected losses

- Requires technical knowledge for setup and troubleshooting

- Market shocks can disrupt algorithm performance

How to get started with an automated trading platform

- Choose an FCA-regulated broker – Select trusted platforms like eToro, IG, XTB, or AvaTrade that support automation, APIs, or copy trading tools.

- Define your strategy – Decide between using existing systems (e.g. CopyTrader, EAs) or building your own algorithm.

- Backtest performance – Test the strategy on historical data to assess profitability, drawdowns, and consistency.

- Use demo mode – Validate your system in a risk-free environment before trading live.

- Go live gradually – Start with small amounts and increase exposure as results prove stable.

- Monitor and optimise – Track performance, adjust settings, and update parameters as market conditions shift.

Success in automated trading depends on discipline, testing, and continuous optimisation.

How to choose the right automated trading platform

Selecting the best automated trading platform depends on your goals, strategy, and preferred markets.

Here’s what to compare before you start:

- Trading goals and strategy: Match the platform to your trading style; day trading, swing trading, or long-term investing.

- Markets and assets: Confirm it supports the instruments you want, such as forex, stocks, crypto, or CFDs.

- Ease of use: Look for a user-friendly interface that suits your experience level.

- Automation tools: Check for backtesting, algorithm builders, or copy trading features.

- Security and regulation: Always choose FCA-regulated platforms with proven reliability.

- Fees and deposits: Review spreads, commissions, data feeds, and any minimum deposit requirements.

- Customer support: Ensure responsive, 24/5 assistance is available.

- Demo accounts: Use free demo modes to test strategies risk-free.

- Reputation and reviews: Prioritise brokers with strong performance history and positive user feedback.

- Broker integration: Confirm the platform connects seamlessly with your chosen broker.

A stable, customisable, and well-supported platform can make a major difference to your results. Testing multiple brokers with demo accounts is the best way to find one that fits your trading goals, automation needs, and comfort level.

Future of automated trading

Automated trading in the UK is entering a new phase driven by AI, machine learning, and big data analytics. Emerging systems will:

- Use predictive algorithms that analyse real-time market and sentiment data

- Deploy self-optimising models that learn and adapt to new conditions

- Enable cross-asset automation across forex, crypto, and equities in unified platforms

- Integrate MiFID II and FCA compliance monitoring by default

- Expand access through mobile and cloud-based automation tools

As institutional-grade AI tools become available to retail traders, automation will continue to improve speed, accuracy, and accessibility, reshaping how UK investors trade in 2025 and beyond.

Final thoughts

Automated trading is transforming how UK investors approach the markets.

By combining AI-driven analytics, FCA-regulated platforms, and data-backed strategies, traders can achieve faster, more disciplined execution.

The key is choosing a trusted broker, testing strategies thoroughly, and maintaining oversight to balance automation with informed decision-making.

FAQs

What is the best automated trading app UK?

The best automated trading apps in the UK include eToro, IG, and AvaTrade. Each app presents unique features catering to different trading styles. Comparing their tools, fees, and user feedback can help determine the best fit for individual traders. It’s essential to choose based on personal trading goals and experience.

Can you really make money with automated trading?

Yes, it is possible to make money with automated trading. Automated trading systems can execute trades quickly and efficiently based on predefined rules and strategies. When properly designed and implemented, automated trading can help capture trading opportunities, manage risk, and potentially generate profits. However, it’s important to note that success in automated trading depends on factors such as the quality of the trading strategy, market conditions, risk management techniques, and ongoing monitoring and adjustment. It’s recommended to thoroughly test and optimise automated trading strategies and stay informed about market trends to increase the chances of success.

Is automated trading legal in the UK?

Yes, automated trading is legal in the UK. The Financial Conduct Authority (FCA) regulates financial activities in the UK, including automated trading. Traders and investors are allowed to use automated trading systems and algorithms to execute trades in the financial markets, as long as they comply with relevant regulations and follow proper risk management practices. While automated trading is legal, individuals should ensure they understand the risks involved and make informed decisions when using automated trading systems.

Can beginners use trading bots?

Yes, many UK trading platforms offer beginner-friendly automated tools. Platforms such as eToro (CopyTrader) and AvaTrade allow users to automate trades without coding. Beginners can start with copy trading, where trades from experienced investors are mirrored automatically. It is advisable to begin with a demo account, test performance, and limit exposure while learning risk management.

Do professional traders use bots?

Yes, institutional and professional traders rely heavily on algorithmic systems for speed and precision. Automated trading dominates volume in forex and equity markets, allowing professionals to manage large positions and complex hedging strategies simultaneously. Retail traders can now access similar technologies through platforms like IG (ProRealTime, MT4, and API) and CMC Markets (MetaTrader 4), which provide institutional-grade automation features.

How much do automated trading platforms cost?

Costs vary by provider. Many UK brokers offer free access to automation tools, while others charge for advanced features.

– eToro, XTB, AvaTrade: No platform fees; spreads apply per trade.

– IG ProRealTime: Free for active traders (minimum four trades/month); otherwise subject to a small monthly fee.

– MetaTrader 4/5: Free to use, but some Expert Advisors (EAs) or third-party bots may have one-time or subscription costs.

– VPS hosting: Optional monthly cost (£20–£50) for 24/7 system uptime.

Always consider spreads, commissions, and overnight financing charges in your total cost calculation.

Can I use TradingView for automated trading?

Yes, TradingView supports automated trading through its Pine Script coding language and integration with brokers that provide API access (such as IG or OANDA). Traders can build custom indicators, generate alerts, and connect their scripts to execute trades automatically via supported integrations. While not a broker itself, TradingView acts as a strategic control panel for rule-based automation.

Which broker allows bots?

Most FCA-regulated brokers support bot integration through MetaTrader, APIs, or third-party plugins.

Common examples include:

– IG: offers API and MT4 compatibility for Expert Advisors.

– AvaTrade: integrates with Capitalise, DupliTrade, and MetaTrader 4/5.

– XTB: supports semi-automated trading through xStation 5.

– CMC Markets: supports automation via MT4 and custom scripts.

Ensure the broker’s infrastructure allows low-latency execution and reliable server uptime for consistent bot performance.

You may also like:

- Guide to trading platforms in the UK

- Guide to stock trading apps in the UK

- Guide to forex trading apps in the UK

Sources: