Do not invest in crypto-assets unless you are prepared to lose all the money you invest. Please keep in mind that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

eToro is an FCA-regulated trading platform that lets you invest in stocks, ETFs, forex, and crypto all in one place.

Known for its social trading tools and low-fee structure, it allows beginners and experienced traders to copy strategies, share insights, and diversify portfolios easily.

This eToro review examines the platform’s features, regulation, fees, and usability, showing how it compares with other UK stock brokers.

Each category is rated using Sterling Savvy’s nine-point testing framework, where we assess platforms on safety, cost, and user experience to deliver clear, evidence-based ratings.

You can read about ‘how we test‘ here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

How does eToro perform overall?

Overall rating: 4.5 stars

Based on detailed testing across nine categories, eToro achieved 75 points, giving it an overall score of 83.33% or 4.5 stars.

This strong result reflects eToro’s balance of low fees, trusted regulation, and a user-friendly trading experience.

Key strengths include:

- Low trading fees

- FCA regulation ensuring investor protection

- Segregated client funds for security

- FSCS protection up to £85,000

- Clean regulatory record with no major incidents

Below is the full category breakdown:

| Category | Points | Star rating |

|---|---|---|

| Fees | 8.3 | ⭐ 4.5 |

| Safety | 7.4 | ⭐ 4 |

| Onboarding | 9.3 | ⭐ 5 |

| Deposit & withdrawal methods | 6.7 | ⭐ 3.5 |

| Markets | 8.9 | ⭐ 4.5 |

| Tools | 8.8 | ⭐ 4.5 |

| Investment & trading platform | 8.6 | ⭐ 4.5 |

| Education | 10 | ⭐ 5 |

| Customer service | 7 | ⭐ 3.5 |

Verdict: eToro performs best in education, onboarding, and market range, making it one of the most balanced, FCA-regulated platforms for UK investors.

How much does eToro charge in fees?

Fees rating: 4.5 stars

eToro is known for its low and transparent fee structure, making it one of the most affordable trading platforms in the UK. You can open an account for free, with no management fees and 0% commission on stocks and ETFs.

However, some charges apply, including spreads, FX conversion fees, a $5 withdrawal fee, and a $10 monthly inactivity fee after 12 months of no login activity.

Below is a full breakdown of how eToro’s fees work across different asset types:

Stocks and ETFs

- 0% commission on buying and selling real stocks and ETFs

- No management, rollover, or ticket fees

- $5 withdrawal fee

- FX conversion fees may apply for non-USD transactions

Crypto trading

- 1% flat fee on each buy or sell transaction, included in the displayed market price

- The 1% applies when opening and closing a position

- No overnight or interest-based fees, unlike some brokers that charge daily financing costs

CFD trading

- CFD fees are spread-based, with variable overnight charges depending on the asset.

Typical spreads:

| Asset type | Charges start from |

|---|---|

| Currencies | 1 pip |

| Commodities | 2 pips |

| Indices | 0.75 points |

| Stocks & ETFs (CFDs) | 0.15% |

Forex trading

- No commissions on trades, but spreads and overnight fees apply.

| Currency pair | Spread from |

|---|---|

| EUR/USD | 1 pip |

| USD/JPY | 1 pip |

| GBP/USD | 2 pips |

| USD/CHF | 1.5 pips |

| EUR/GBP | 1.5 pips |

Non-trading fees

| Type | Amount |

|---|---|

| Account fee | $0 |

| Inactivity fee | $10 per month |

| Deposit fee | Free |

| Withdrawal fee | $5 |

| Replacement debit card fee | £10–£80 |

| FX conversion fee | Yes, based on pips |

| Stamp duty reserve tax | 0.5% |

Pros

- No deposit fees

- 0% commission on stocks and ETFs

- Low CFD and forex spreads

- Free account opening

Cons

- $10 inactivity fee

- $5 withdrawal fee

- FX conversion charges for non-USD deposits

Verdict: eToro offers one of the best low-fee setups in the market for retail investors, especially for stock, ETF, and crypto trading. The main costs come from non-trading fees, which are easy to manage with regular account activity.

How safe is eToro to use?

Safety rating: 4 stars

eToro is considered a safe and regulated trading platform for UK users. It is authorised and regulated by the Financial Conduct Authority (FCA) and provides FSCS protection of up to £85,000 in the event of broker insolvency.

All client funds are held in segregated bank accounts, meaning your money is kept separate from eToro’s operational funds.

This safeguard ensures user deposits remain secure even in the unlikely event of company failure.

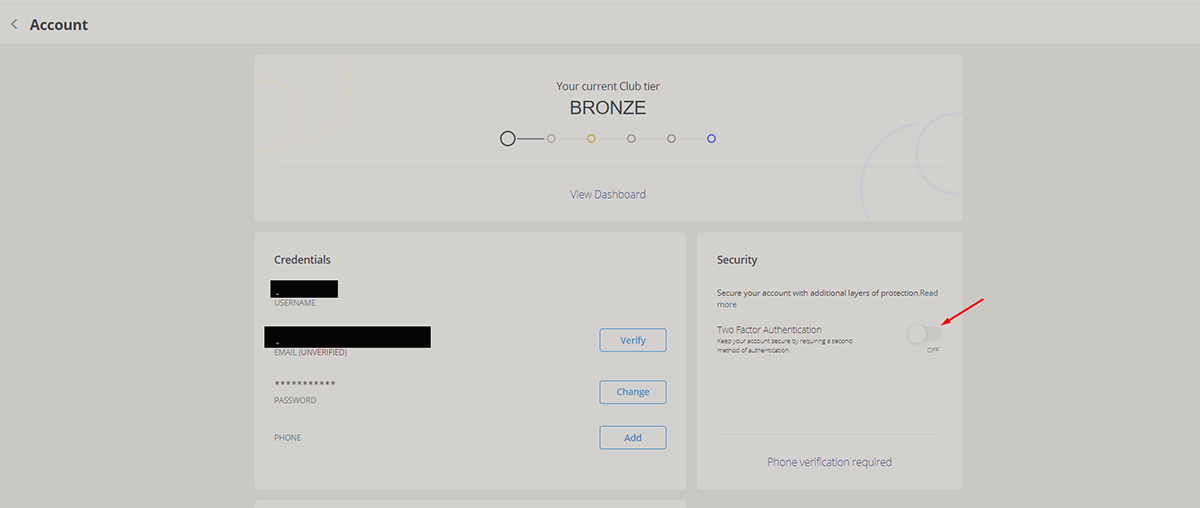

From a cybersecurity perspective, eToro meets ISO 27001 and PCI-DSS standards, showing strong commitment to data security. The platform uses two-factor authentication (2FA) to protect logins, sending a unique verification code by SMS or call whenever users access their accounts.

These layers of protection make eToro one of the more secure brokers in the UK market, though users should still take precautions such as enabling 2FA and using strong passwords.

Pros

- FCA-regulated and FSCS protection up to £85,000

- Segregated client accounts

- ISO 27001 and PCI-DSS certified

- Strong 2FA login security

- Global regulatory compliance

Cons

- Reports in 2020 of alleged data exposure, though eToro denied any breach

Verdict: eToro meets top UK security and compliance standards, combining FCA regulation with advanced cybersecurity protections to safeguard user funds and data.

How easy is it to open an account with eToro?

Onboarding rating: 5 stars

Opening an account with eToro is quick, simple, and fully digital. The signup process takes only a few minutes, and users can start with a free demo account loaded with virtual funds to practise trading before depositing real money.

You can register using your Google, Facebook, or email account. After signup, eToro will prompt you to verify your profile by providing your name, date of birth, and contact details. Full verification requires:

- Proof of identity (passport or photo ID)

- Proof of address (utility bill or bank statement dated within 3 months)

The minimum deposit for UK users is $50, which is competitive compared to other brokers. IG has no minimum for bank transfers, while Plus500 requires around £76, placing eToro comfortably in the middle.

Pros

- Fast and seamless signup

- Online verification process

- Free demo account with virtual funds

Cons

- $50 minimum deposit required

Verdict: eToro’s onboarding process is one of the easiest among UK brokers. The smooth verification, demo account access, and quick setup make it ideal for beginners testing the platform.

How do deposits and withdrawals work on eToro?

Deposit and withdrawal rating: 3.5 stars

eToro offers several convenient payment methods for UK users, though a few limitations apply. All eToro trading accounts are denominated in USD, but UK traders can also use the eToro Money account to hold and withdraw GBP, helping reduce conversion costs.

You can deposit using credit or debit cards, bank transfers, and e-wallets. Deposits are usually instant, and users can manage both USD and GBP balances, USD in the main trading account and GBP in eToro Money.

When depositing any currency other than USD, eToro automatically converts funds at the current market rate. Using eToro Money for deposits helps avoid conversion fees, which can save regular traders money.

Withdrawals are straightforward, but all accounts must be fully verified, and there’s a $30 minimum withdrawal with a $5 fee per transaction. Processing times depend on the payment method.

Deposit methods for UK users

| Method | Processing time | Maximum limit | Supported currencies |

|---|---|---|---|

| eToro Money | Instant | £250,000 (unlimited for Black Card users) | GBP |

| Credit/debit card | Instant | $40,000 | USD, GBP, EUR, AUD |

| Bank transfer | 4–7 days | Unlimited | USD, GBP, EUR |

Withdrawal methods and durations

| Method | Processing time |

|---|---|

| eToro Money | Instant* |

| Credit/debit card | Up to 10 business days |

| Bank transfer | Up to 10 business days |

*Some eToro Money withdrawals may process the next business day for security reasons.

Pros

- User-friendly and simple to manage

- GBP and USD accounts available

- Instant deposits and withdrawals via eToro Money

Cons

- $5 withdrawal fee

- Limited base currency (USD)

- Conversion fees on non-USD deposits

- Minimum withdrawal requirement of $30

Verdict: eToro’s deposit and withdrawal system is flexible for UK users, especially when using eToro Money. However, conversion fees and withdrawal charges slightly reduce its overall convenience.

What markets can you trade on eToro?

Markets rating: 4.5 stars

eToro gives UK investors access to a wide range of global markets, allowing trading and investing across multiple asset classes, including stocks, ETFs, forex, commodities, indices, crypto, and CFDs. This variety makes it one of the most versatile platforms for portfolio diversification.

Below is an overview of the markets and available instruments for UK users:

| Asset type | Number available |

|---|---|

| Stocks | 3,424 |

| ETFs | 421 |

| Currencies | 51 |

| Commodities | 32 |

| Indices | 21 |

| Cryptocurrencies | 93 |

Investors can trade real stocks and ETFs commission-free, though the 0% commission does not apply to leveraged or short CFD positions.

eToro’s stock selection spans major global sectors, including technology, healthcare, and energy, giving UK users access to both local and international markets.

You can also trade commodities such as gold, silver, and oil, and invest in indices like the FTSE 100, S&P 500, and NASDAQ for broader exposure.

Forex traders can use leverage of up to 1:30, while crypto investors can access over 90 digital assets, including Bitcoin, Ethereum, and Solana.

In partnership with Moneyfarm, eToro now offers UK investors the ability to open an ISA (Individual Savings Account), providing tax-efficient investing options. However, the platform currently does not support bonds, SIPPs, or Junior SIPPs.

Pros

- Access to multiple markets and asset types

- Over 4,000 instruments available

- Commission-free stock and ETF trading

- ISA investing available through Moneyfarm partnership

Cons

- No bond, SIPP, or Junior SIPP options

Verdict: eToro offers one of the broadest market selections of any FCA-regulated broker in the UK, combining traditional assets with CFDs and crypto, ideal for both beginners and diversified investors.

What trading tools does eToro offer?

Tools rating: 4.5 stars

eToro provides a strong suite of trading and research tools designed to help users make better investment decisions. All key tools are accessible through the “Discover” tab, which gives traders real-time insights, market data, and expert analysis across thousands of assets.

Users can view performance charts, market stats, and analyst forecasts for individual assets. Each asset page displays performance data over daily, weekly, monthly, or yearly periods, along with details such as market cap, trading volume, and price-to-earnings ratios.

For stocks, eToro even includes ESG (Environmental, Social, and Governance) scores, allowing users to evaluate companies by sustainability standards.

Smart Portfolios

One of eToro’s standout tools is its Smart Portfolios, professionally managed, theme-based investment bundles that combine multiple assets under a single strategy.

These portfolios are research-backed, diversified, and have no management fees, although the minimum investment is $500. They’re ideal for users who want expert guidance without managing individual trades.

Other tools available

- Economic calendar: Displays key market events and announcements that could affect asset prices.

- Ticker and news feed: Offers real-time updates and market news tailored to your preferences.

- Asset insights: Provides technical charts and trend analyses for each market.

Note that some research tools, such as the “Analysis” and “News” tabs, are only available on real accounts, not demo accounts.

Pros

- Smart Portfolios for hands-free investing

- Access to detailed market data and analysis

- Built-in news feed and economic calendar

Cons

- $500 minimum for Smart Portfolios

- Limited access to tools on demo accounts

Verdict: eToro’s trading tools are comprehensive and easy to use, offering deep insights for beginners and experienced investors alike. Smart Portfolios, combined with live analytics and market updates, make it a reliable platform for research-driven trading.

How does the eToro trading platform work?

Platform rating: 4.5 stars

eToro offers an intuitive and modern web and mobile trading experience, available on both iOS and Android.

There is no standalone desktop app, but the browser-based platform is well designed, fast, and easy to navigate, making it suitable for both beginners and active traders.

A standout feature is CopyTrader, which allows users to automatically copy trades from top-performing investors on the platform.

You can filter traders by returns, risk score, duration, and asset type, then mirror their trades in real time with a minimum of $200 per copied trader. Copying can be started or stopped at any time, giving full control and transparency over your investments.

The platform also integrates a Social News Feed, where traders can share insights, post strategies, and discuss market updates. Each trader’s performance history and risk metrics are publicly displayed, helping users make informed decisions based on verified data.

Pros

- Simple and user-friendly web and mobile apps

- CopyTrader allows users to mirror expert traders

- Available on both iOS and Android

- Transparent trader performance data

Cons

- No desktop application

- $200 minimum for CopyTrader

- Lacks some advanced trading tools

Verdict: eToro’s trading platform is one of the most user-friendly options in the UK. The combination of social trading, CopyTrader, and seamless mobile access makes it ideal for those seeking a community-driven investing experience.

What educational resources does eToro provide?

Education rating: 5 stars

eToro offers an excellent range of educational materials for beginners and experienced investors alike. The Education section on its website includes regularly updated news, market analysis, and featured articles that cover stocks, crypto, forex, and other assets.

Users can filter topics to match their interests, making it easy to stay informed on relevant market trends and opportunities.

A standout feature is the eToro Academy, which includes four structured courses designed to teach users the fundamentals of investing, trading strategies, and portfolio management.

The lessons are available in video, text, and interactive formats, allowing you to learn at your own pace.

In addition to the Academy, eToro also provides:

- Digest & Invest – a podcast offering quick insights into market news

- eToro Plus – a hub for in-depth articles and commentary

- Retail Investor Beat – reports on investor behaviour and sentiment

These resources help users develop stronger financial literacy, refine their strategies, and make informed trading decisions.

Pros

- Comprehensive courses for beginners

- Free guides, articles, and video lessons

- Regularly updated news and market analysis

Cons

- Limited focus on advanced technical analysis

Verdict: eToro’s education offering is among the best available from an FCA-regulated broker. With expert-led courses and accessible materials, it’s ideal for users looking to improve their investing knowledge while using the platform.

How good is eToro’s customer service?

Customer service rating: 3.5 stars (7/10)

eToro’s customer support is helpful but could be improved in terms of availability and contact options. Users can reach the support team by submitting web-based tickets through the platform, and most queries are handled via the Help Center, which includes detailed FAQs and troubleshooting guides.

While these resources cover common issues effectively, support is only available during office hours, which can be limiting for traders who need help outside standard times. The absence of live chat or phone support also means urgent issues may take longer to resolve.

Extending support hours and adding real-time contact options would greatly enhance the overall customer experience, especially for active traders who rely on quick responses.

Pros

- Comprehensive Help Center with FAQs

- Ticket-based support system

Cons

- Support limited to office hours

- No live chat or phone assistance

Verdict: eToro’s customer service is functional and informative but not 24/7. It works well for non-urgent issues, though faster and more direct communication options would make it more competitive with other top brokers.

Who is eToro best suited for?

eToro is best suited for beginner and intermediate investors who want an easy-to-use, all-in-one trading platform with access to stocks, ETFs, crypto, and CFDs.

Its social trading features, including CopyTrader and Smart Portfolios, make it ideal for users who prefer to learn from or mirror experienced traders rather than trade entirely on their own.

It’s also a strong choice for those who value a community-driven approach to investing, thanks to its integrated social feed where users can discuss strategies and share market insights.

More advanced traders may find the lack of certain professional-level tools restrictive, but the broad market range, FCA regulation, and commission-free stock trading make eToro one of the most accessible and trusted platforms for everyday UK investors.

Best for:

- Beginners who want to start trading easily

- Social traders who want to copy expert portfolios

- Multi-asset investors seeking a single, regulated platform

Final thoughts

eToro stands out as a trusted, FCA-regulated platform that combines traditional investing with innovative social trading features.

Its low fees, intuitive interface, and broad market access make it one of the best options for UK investors looking to trade or build a diversified portfolio.

While customer support and advanced tools could improve, eToro remains a top choice for beginners and everyday investors seeking a safe and user-friendly way to invest online.

FAQs

Can eToro be trusted?

Yes. eToro is a legitimate, FCA-regulated broker trusted by over 30 million users worldwide. It keeps client funds in segregated bank accounts and offers FSCS protection up to £85,000.

Is eToro regulated in the UK?

Yes. eToro (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FCA), ensuring compliance with UK financial laws and investor protection standards.

Do you actually earn from eToro?

Yes, users can earn returns by investing in stocks, ETFs, crypto, and CFDs, but profits are never guaranteed. Trading involves risk, and losses can exceed deposits.

What is the downside to eToro?

The main drawbacks are withdrawal and conversion fees, limited advanced tools, and no 24/7 customer support. CFD trading also carries high risk due to leverage.

Is eToro good for beginners?

Yes. eToro is one of the most beginner-friendly platforms, with a simple interface, demo account, and CopyTrader tools for learning from experienced investors.

Is eToro safe?

Yes. eToro uses bank-grade encryption, two-factor authentication (2FA), and is ISO 27001 certified, ensuring strong account and data security.

Is eToro good for UK users?

Yes. eToro is FCA-regulated, supports GBP deposits via eToro Money, and offers commission-free stock trading, making it ideal for UK investors.

What are the disadvantages of eToro?

Disadvantages include $5 withdrawal fees, USD-only trading accounts, and limited support hours. Advanced traders may find the tools too basic.

Can I withdraw money from eToro UK?

Yes. UK users can withdraw funds via eToro Money, bank transfer, or card, once their account is verified. The minimum withdrawal amount is $30.

How much does eToro charge to cash out?

eToro charges a flat $5 withdrawal fee per transaction. Using eToro Money can help avoid extra conversion fees for GBP withdrawals.

Sources:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilising publicly available non-entity specific information about eToro.